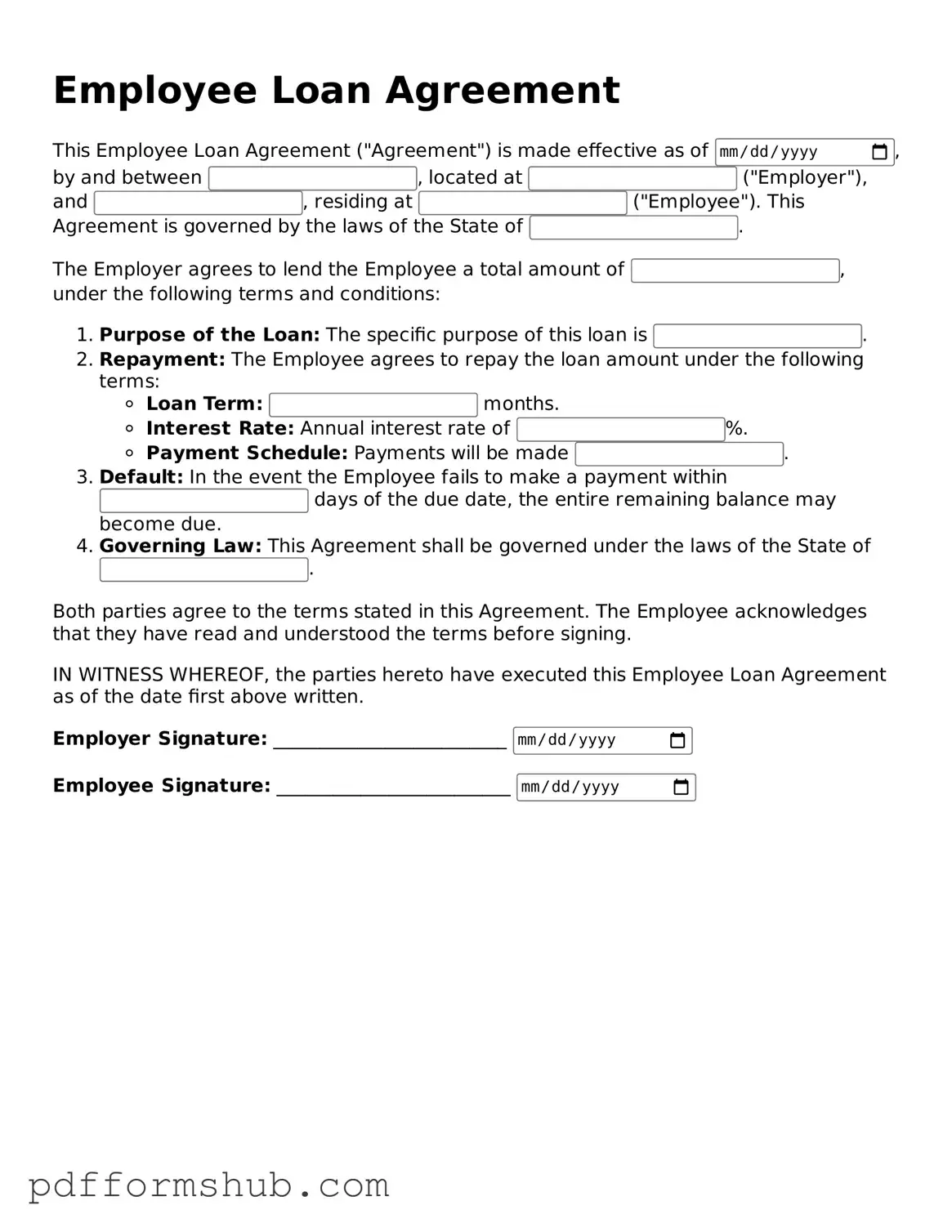

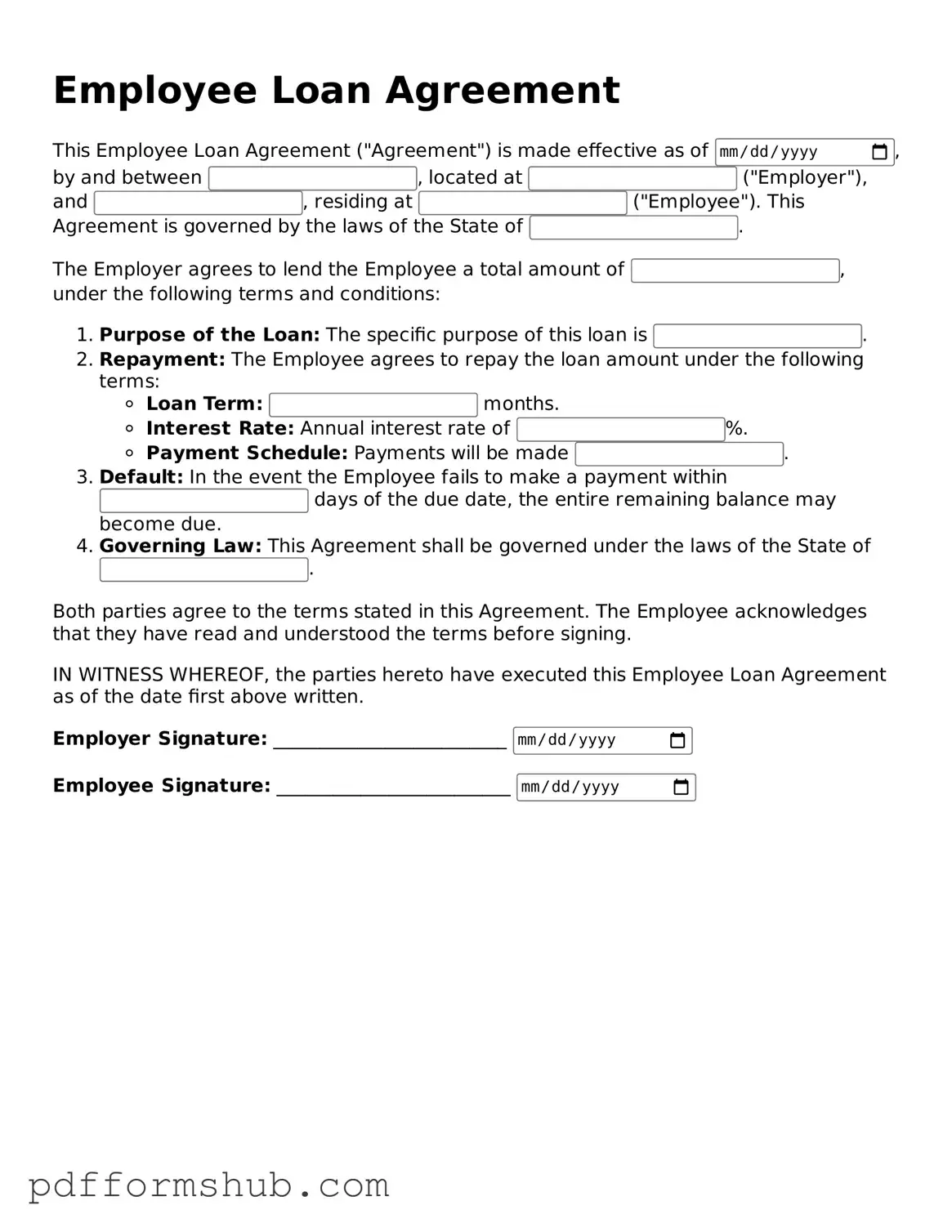

Valid Employee Loan Agreement Form

An Employee Loan Agreement is a document that outlines the terms under which an employer lends money to an employee. This agreement specifies the loan amount, repayment schedule, and any interest rates involved. Understanding this form is essential for both employers and employees to ensure clear communication and compliance with workplace policies.

To fill out the Employee Loan Agreement form, click the button below.

Customize Form

Valid Employee Loan Agreement Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Employee Loan Agreement online without printing hassles.