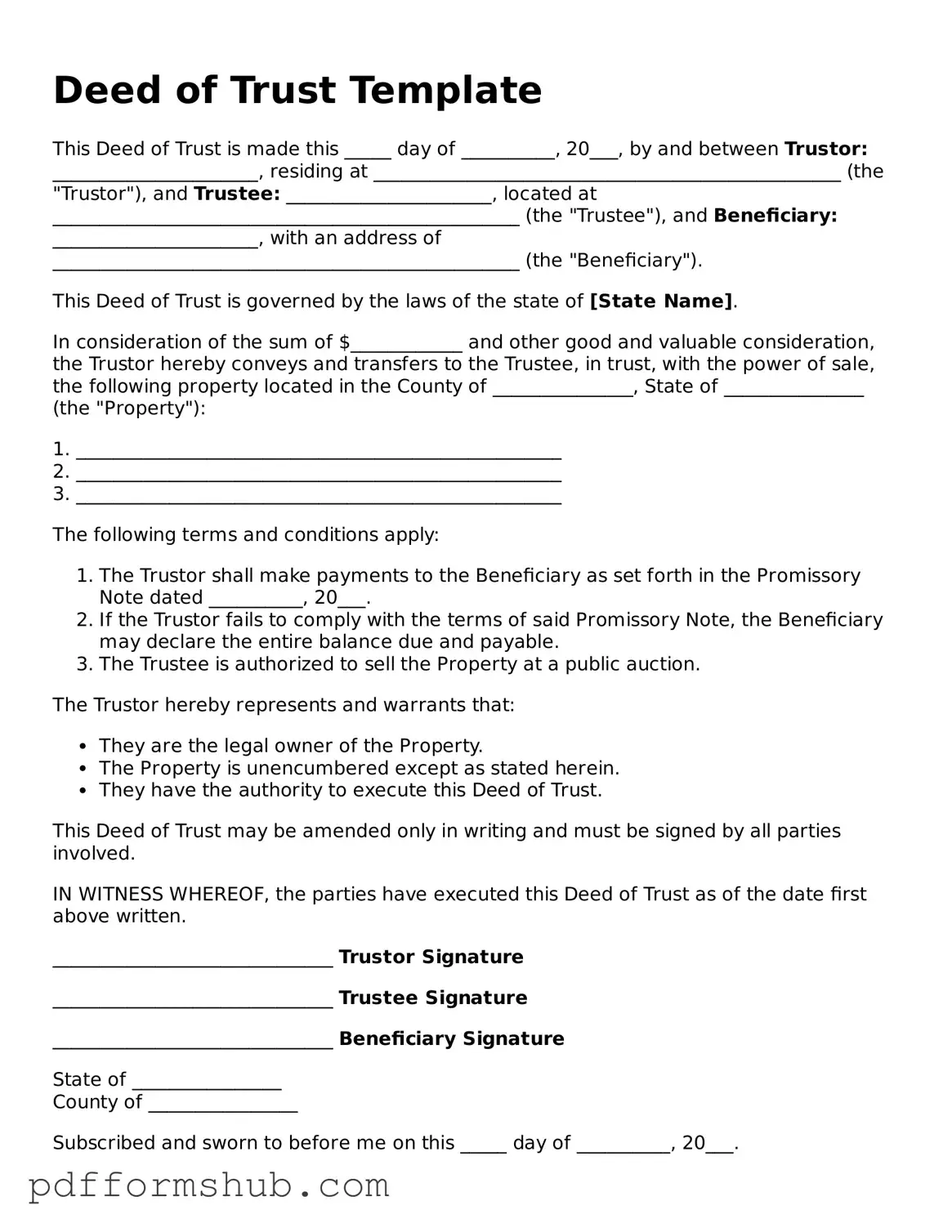

Valid Deed of Trust Form

A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a third party, known as a trustee, until the loan is repaid. This form plays a crucial role in real estate transactions, providing protection for both the borrower and the lender. Understanding the details of this form is essential for anyone involved in property financing.

Ready to take the next step? Fill out the form by clicking the button below.

Customize Form

Valid Deed of Trust Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Deed of Trust online without printing hassles.