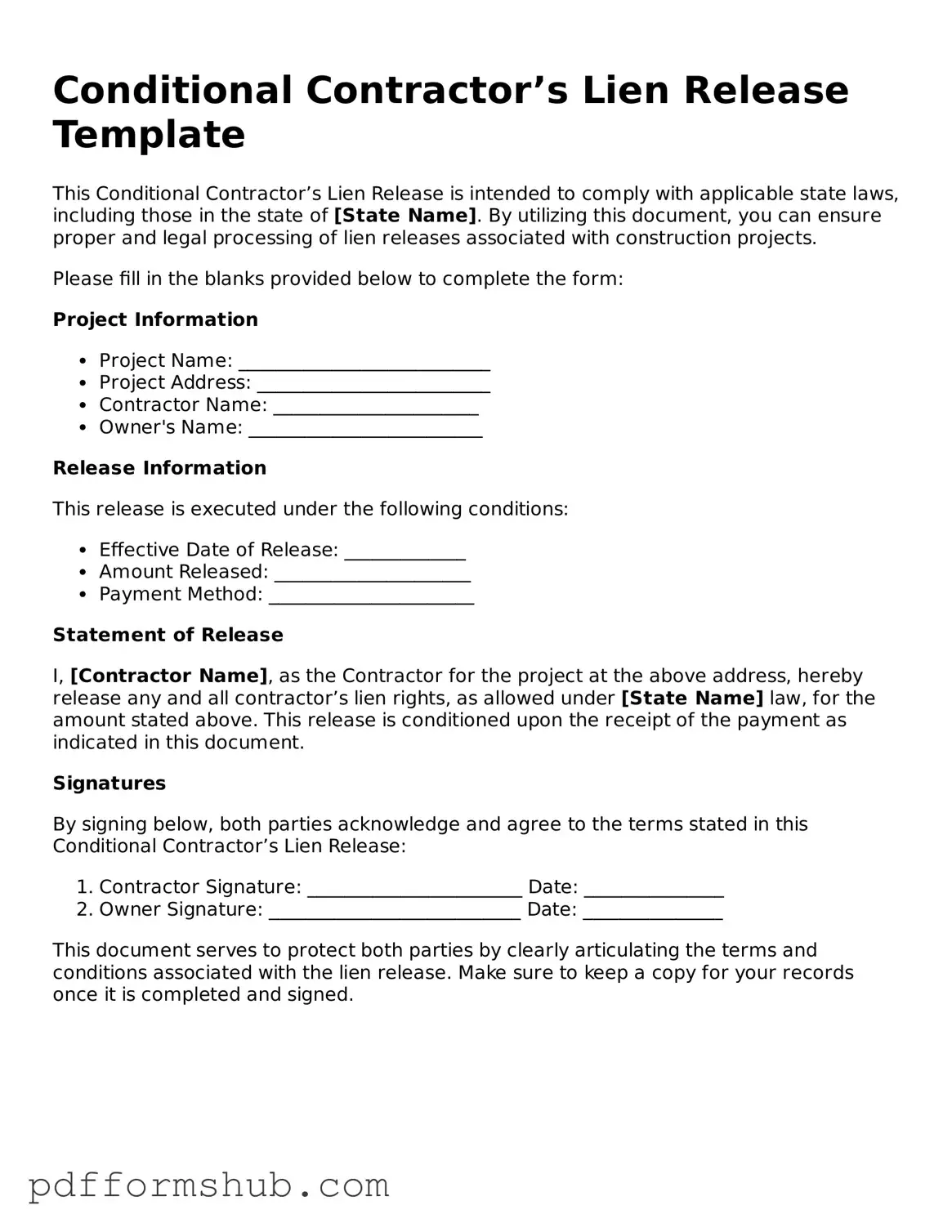

Valid Conditional Contractor’s Lien Release Form

The Conditional Contractor’s Lien Release form is a legal document that allows a contractor to release their claim on a property, contingent upon receiving payment for work completed. This form is crucial for protecting both the contractor's rights and the property owner's interests. If you're ready to fill out the form, click the button below.

Customize Form

Valid Conditional Contractor’s Lien Release Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Conditional Contractor’s Lien Release online without printing hassles.