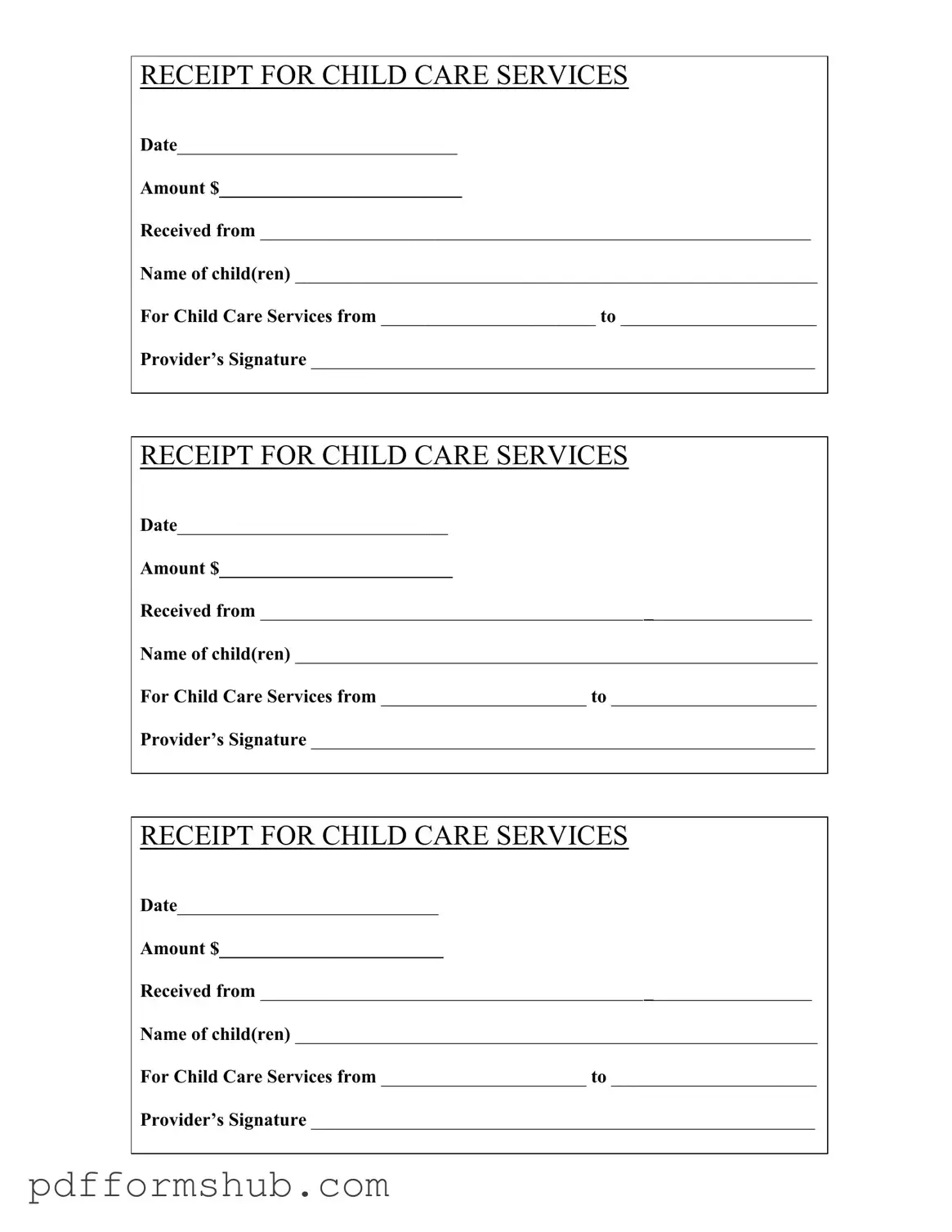

Fill in Your Childcare Receipt Form

The Childcare Receipt form is a document used to acknowledge the payment made for childcare services. It includes essential information such as the date, amount paid, names of the children, and the duration of care provided. To ensure proper record-keeping and potential tax benefits, it is important to fill out this form accurately.

Ready to get started? Fill out the form by clicking the button below.

Customize Form

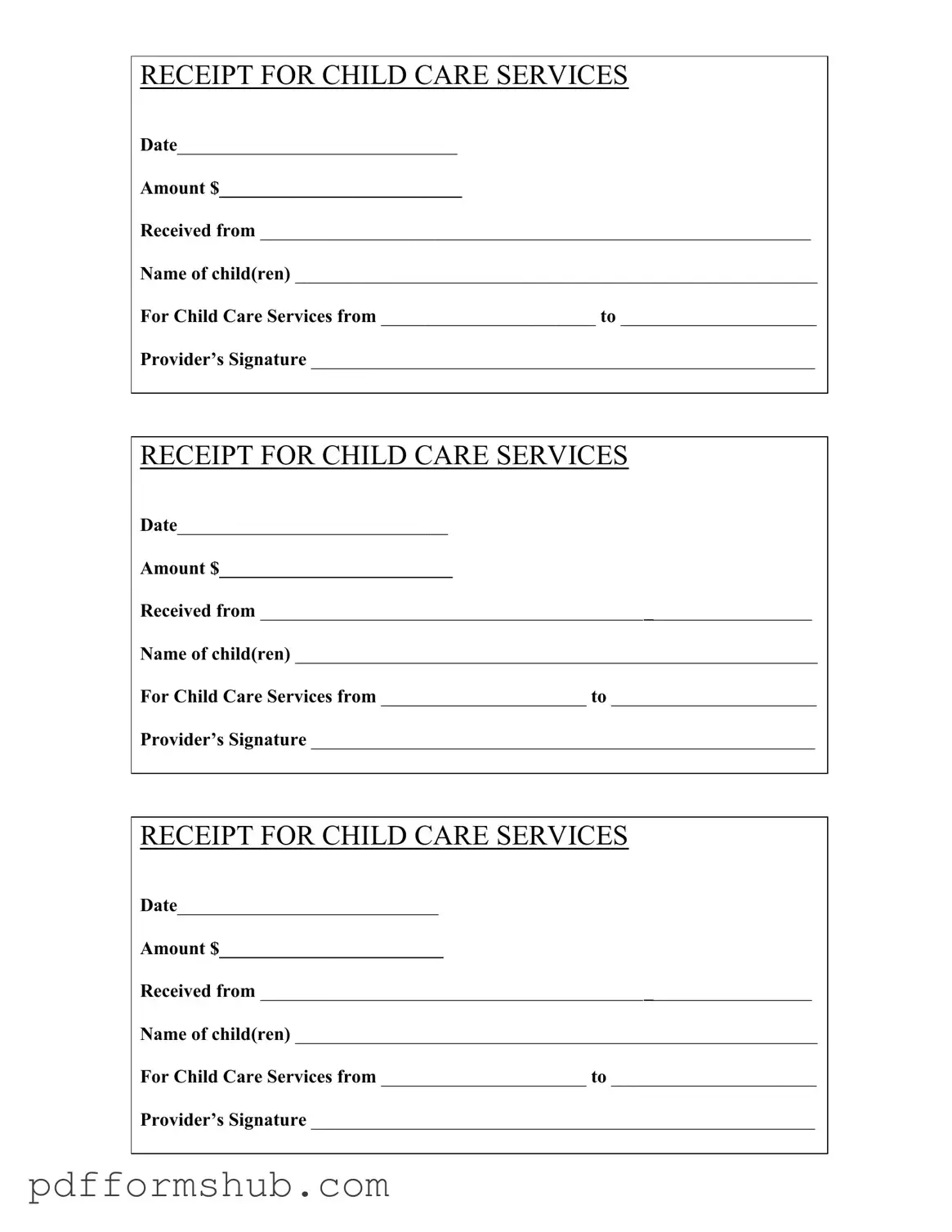

Fill in Your Childcare Receipt Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Childcare Receipt online without printing hassles.