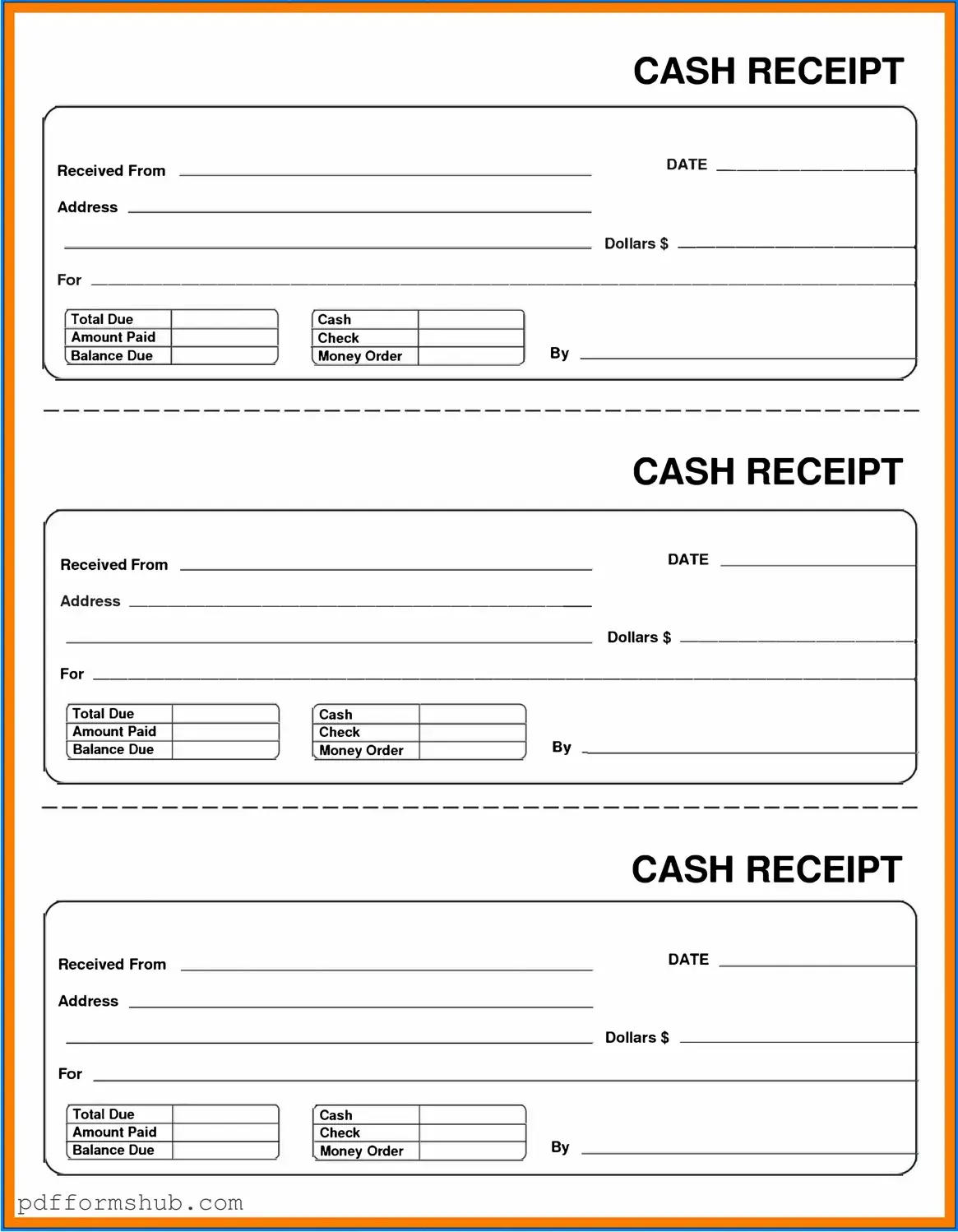

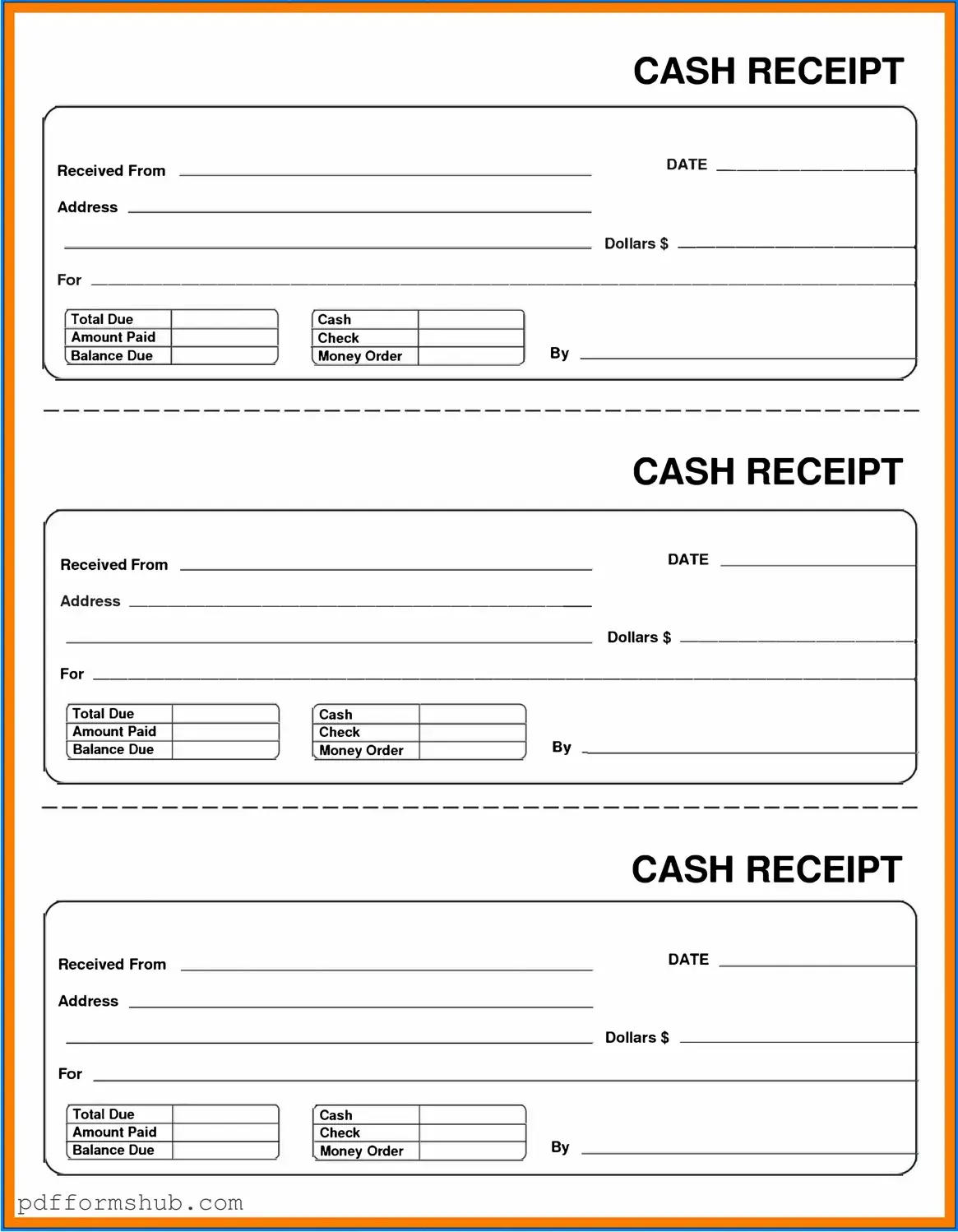

Fill in Your Cash Receipt Form

A Cash Receipt form is a document used to acknowledge the receipt of cash payments. It serves as proof of transaction for both the payer and the payee, ensuring transparency and accountability. For accurate record-keeping, it is essential to fill out this form properly; click the button below to get started.

Customize Form

Fill in Your Cash Receipt Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Cash Receipt online without printing hassles.