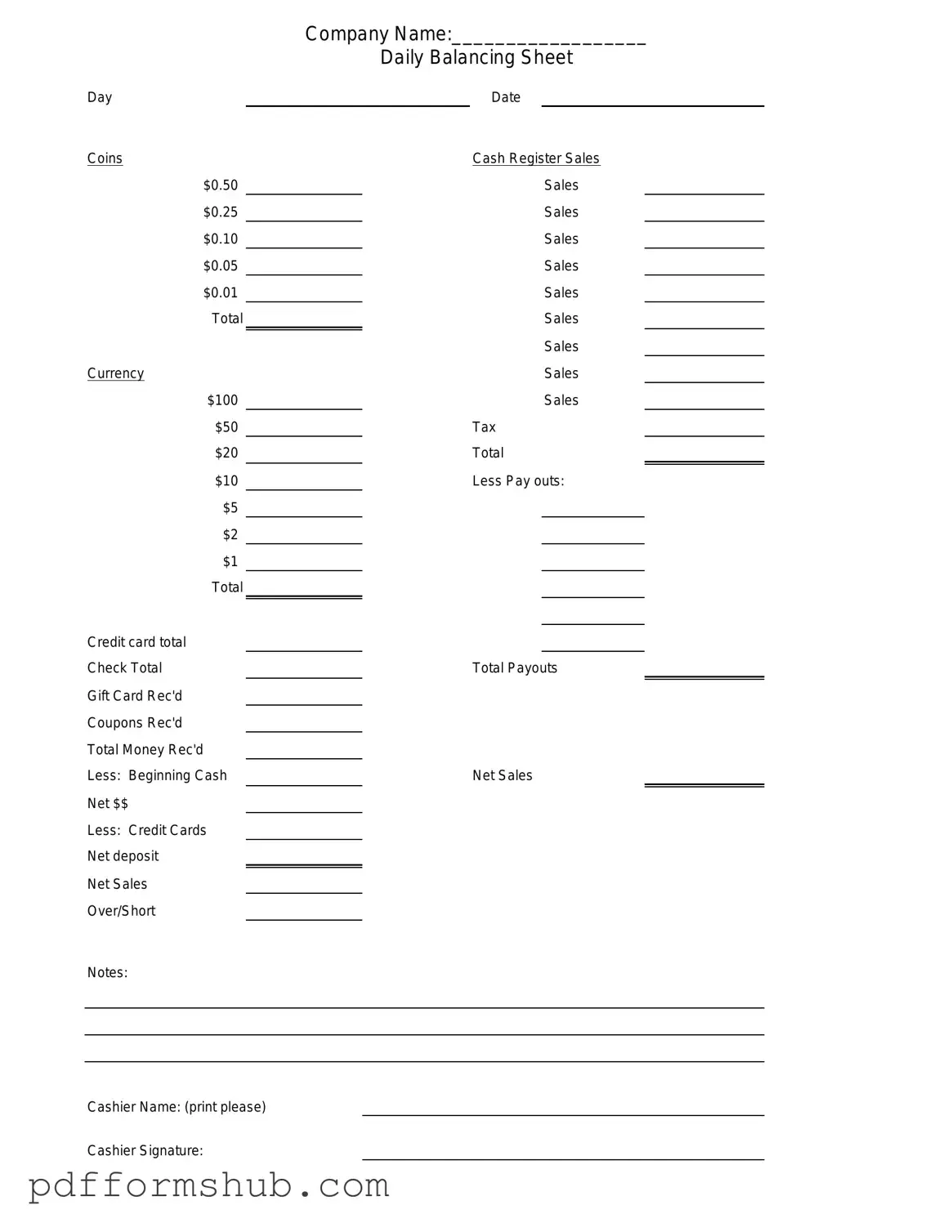

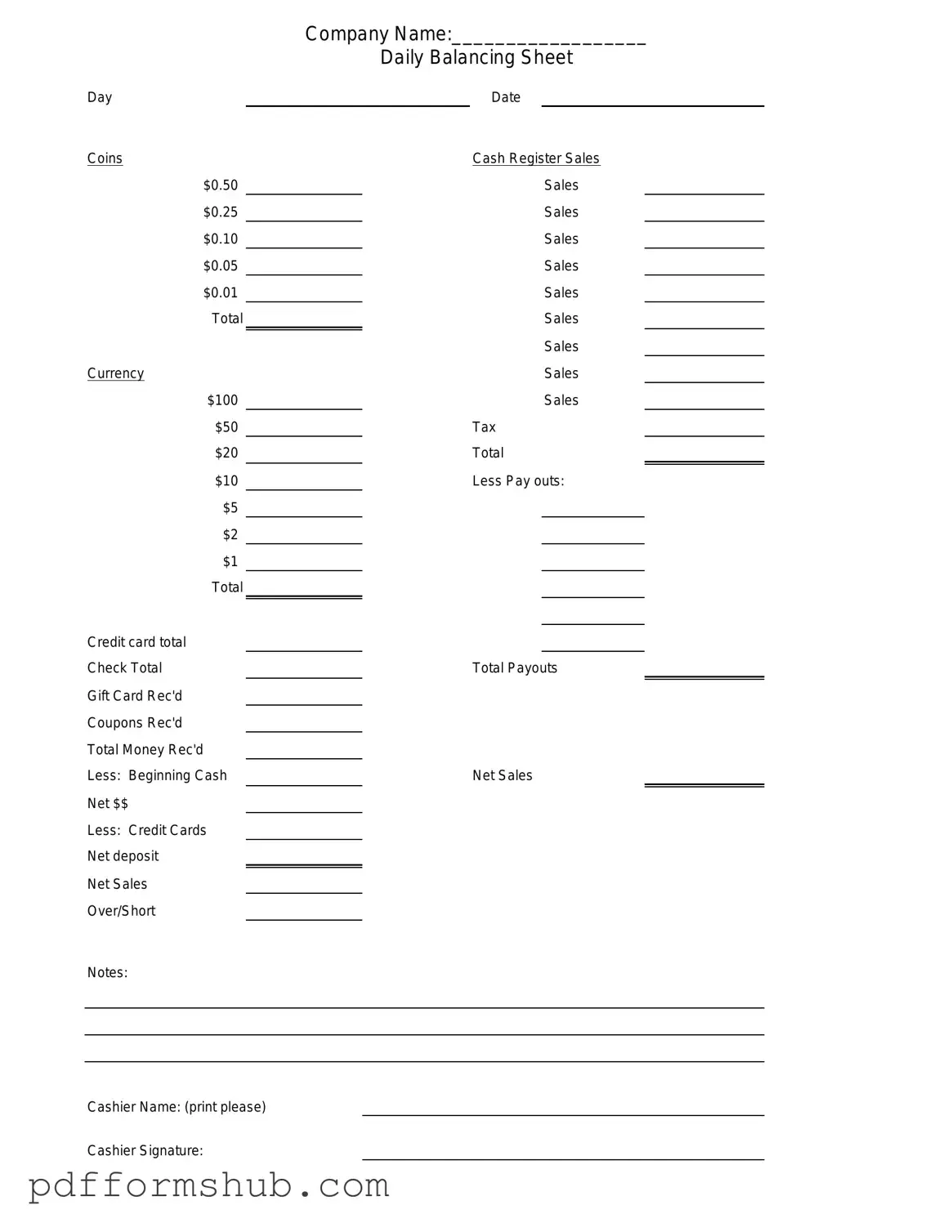

Fill in Your Cash Drawer Count Sheet Form

The Cash Drawer Count Sheet is a vital document used by businesses to accurately track the cash in their registers at the end of a shift or day. This form helps ensure that all transactions are accounted for and assists in identifying discrepancies. By maintaining a clear record, businesses can enhance their financial accuracy and operational efficiency.

Ready to streamline your cash management? Fill out the form by clicking the button below!

Customize Form

Fill in Your Cash Drawer Count Sheet Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Cash Drawer Count Sheet online without printing hassles.