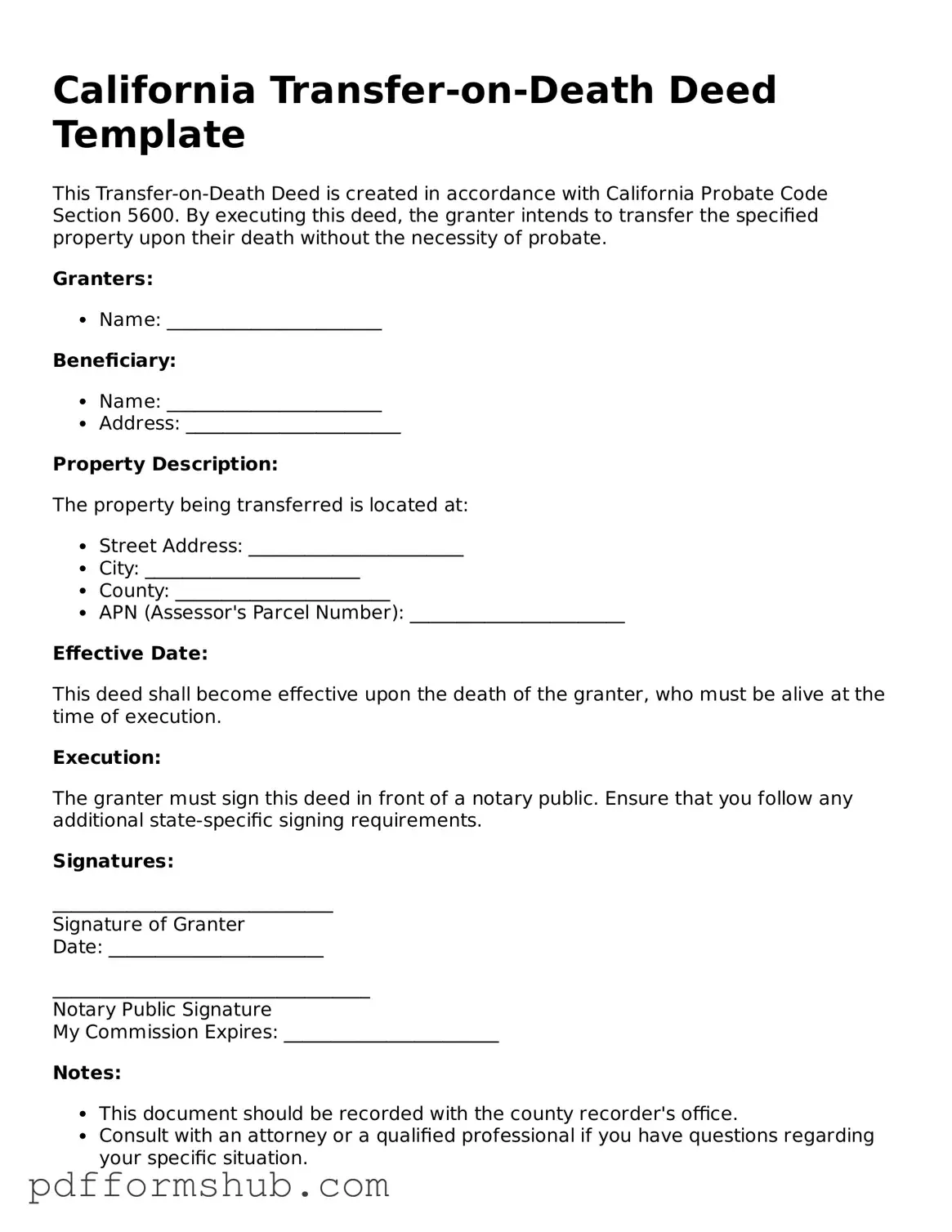

Attorney-Verified Transfer-on-Death Deed Form for California State

The California Transfer-on-Death Deed form allows property owners to designate a beneficiary who will receive their real estate upon the owner's death, bypassing the probate process. This legal tool provides a straightforward method for transferring property, ensuring that the owner's wishes are honored without unnecessary delays. Understanding the implications and requirements of this form is crucial for effective estate planning.

Take the first step in securing your property transfer by filling out the form below.

Customize Form

Attorney-Verified Transfer-on-Death Deed Form for California State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Transfer-on-Death Deed online without printing hassles.