Attorney-Verified Promissory Note Form for California State

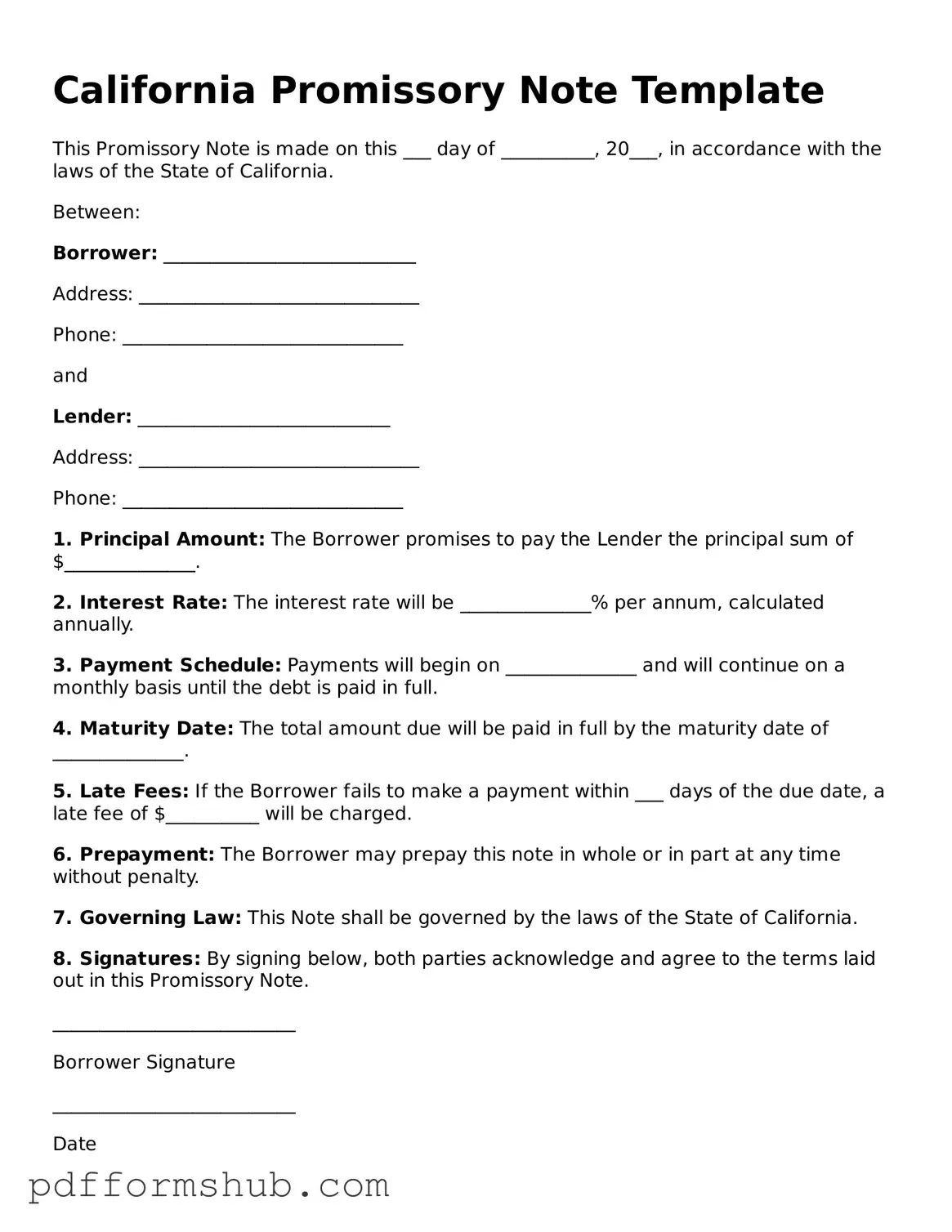

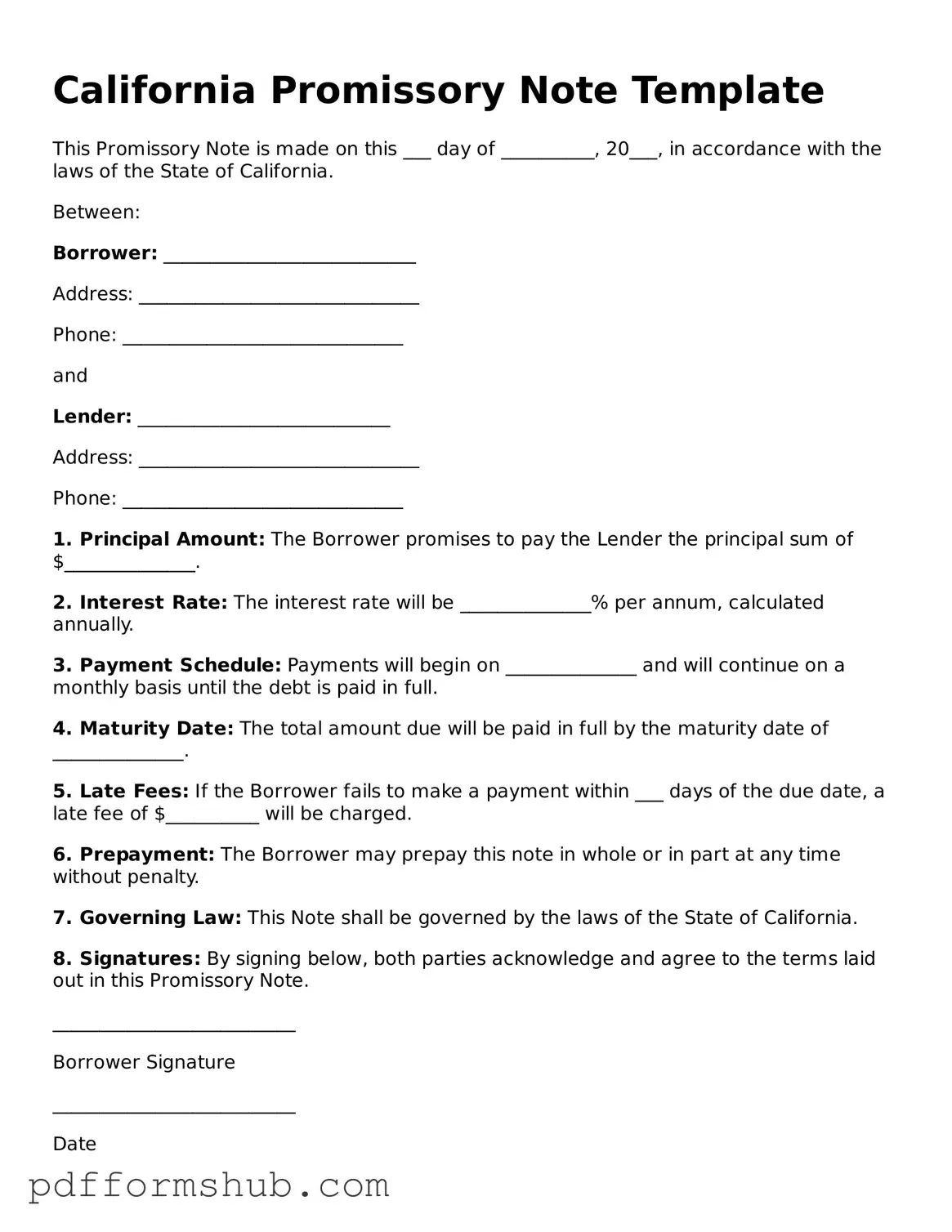

A California Promissory Note is a legal document that outlines a borrower's promise to repay a loan under specified terms. This form serves as a clear agreement between the lender and borrower, detailing the amount borrowed, interest rate, and repayment schedule. Understanding this document is crucial for anyone involved in lending or borrowing money in California.

Ready to take the next step? Fill out the form by clicking the button below!

Customize Form

Attorney-Verified Promissory Note Form for California State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Promissory Note online without printing hassles.