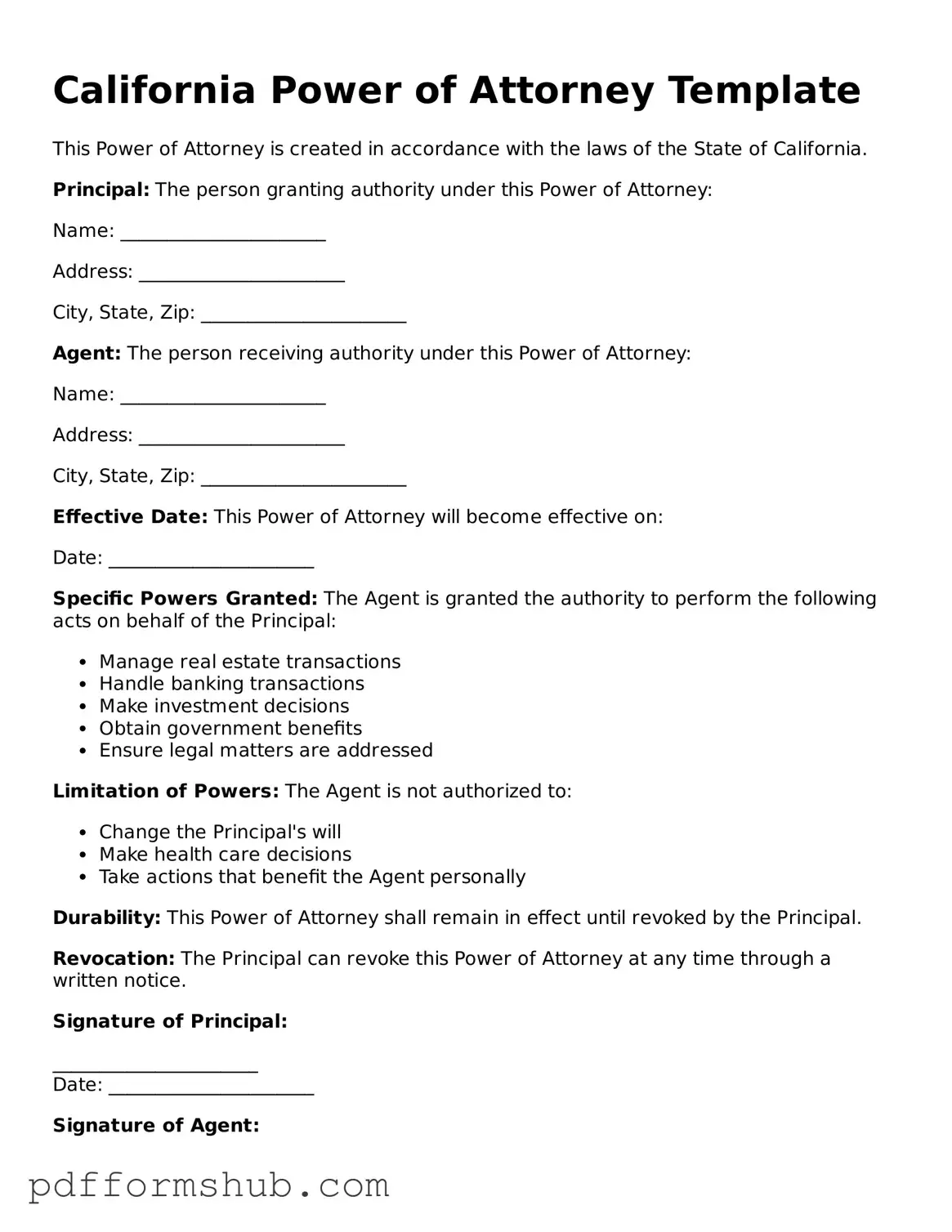

Attorney-Verified Power of Attorney Form for California State

The California Power of Attorney form is a legal document that allows an individual, known as the principal, to designate another person, referred to as the agent, to make decisions on their behalf. This form can cover various areas, including financial matters and healthcare decisions, providing essential flexibility and support in times of need. To take control of your future, consider filling out the form by clicking the button below.

Customize Form

Attorney-Verified Power of Attorney Form for California State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Power of Attorney online without printing hassles.