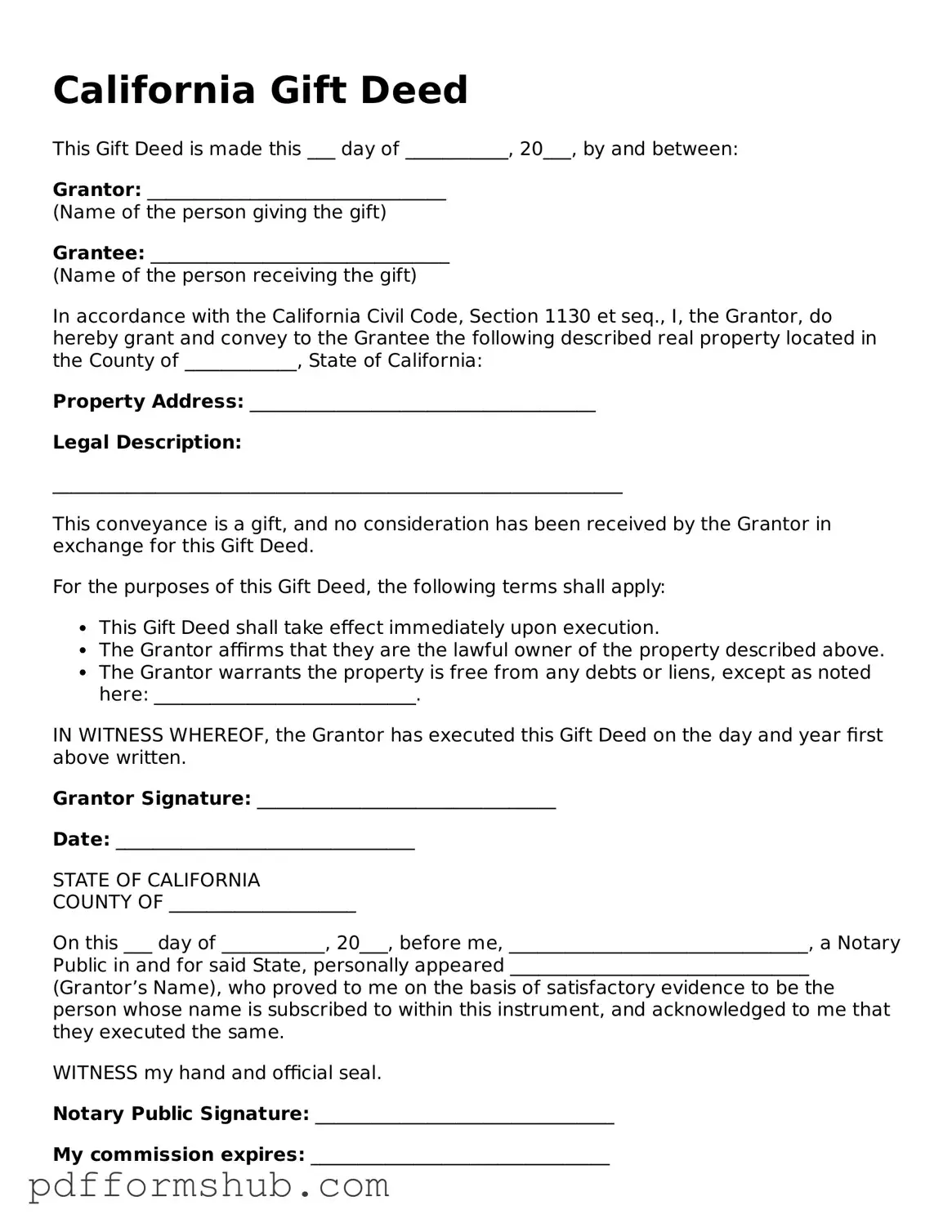

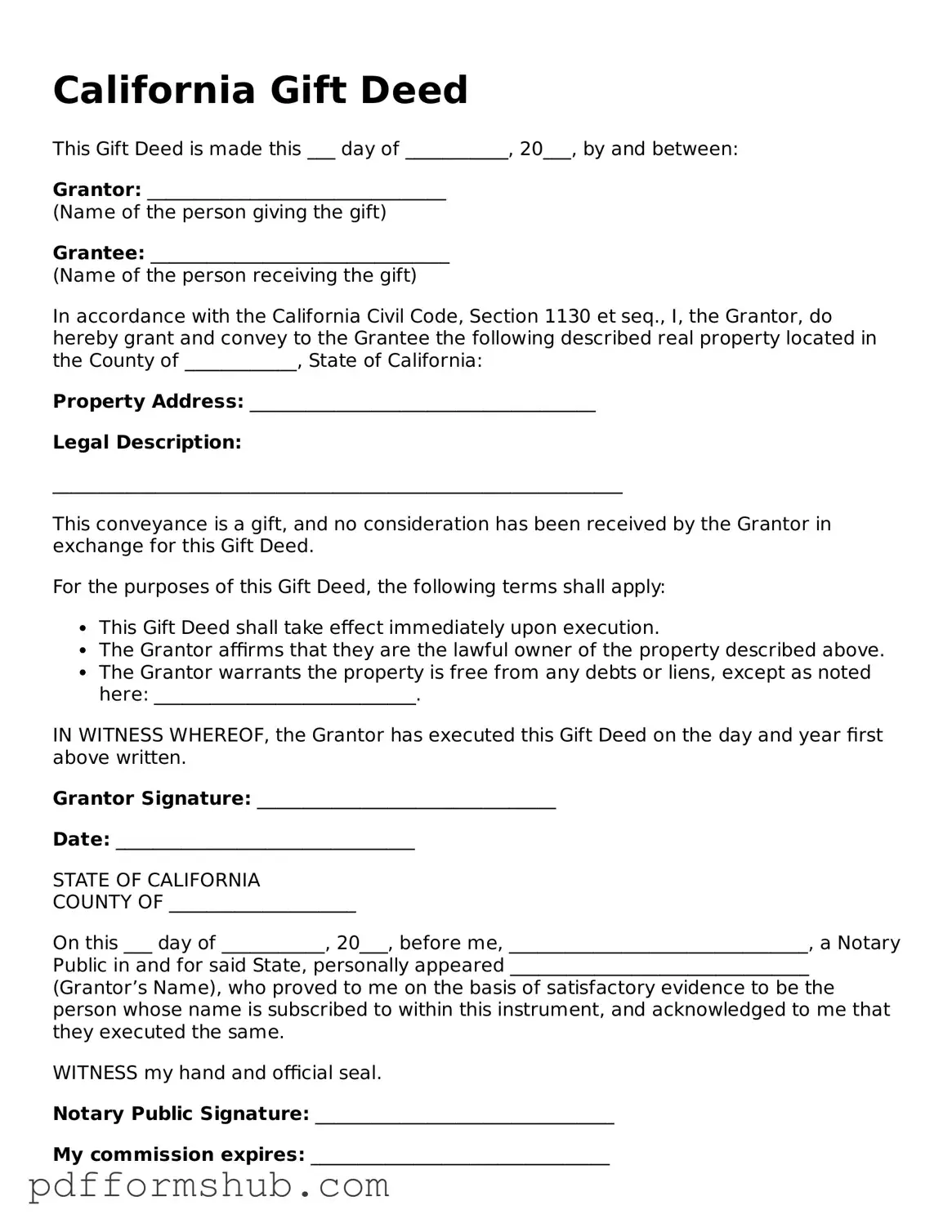

Attorney-Verified Gift Deed Form for California State

A California Gift Deed form is a legal document used to transfer ownership of property from one person to another without any exchange of money. This form allows the giver to make a gift of real estate to the recipient, ensuring that the transfer is clear and legally recognized. If you’re ready to proceed with this important step, fill out the form by clicking the button below.

Customize Form

Attorney-Verified Gift Deed Form for California State

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Gift Deed online without printing hassles.