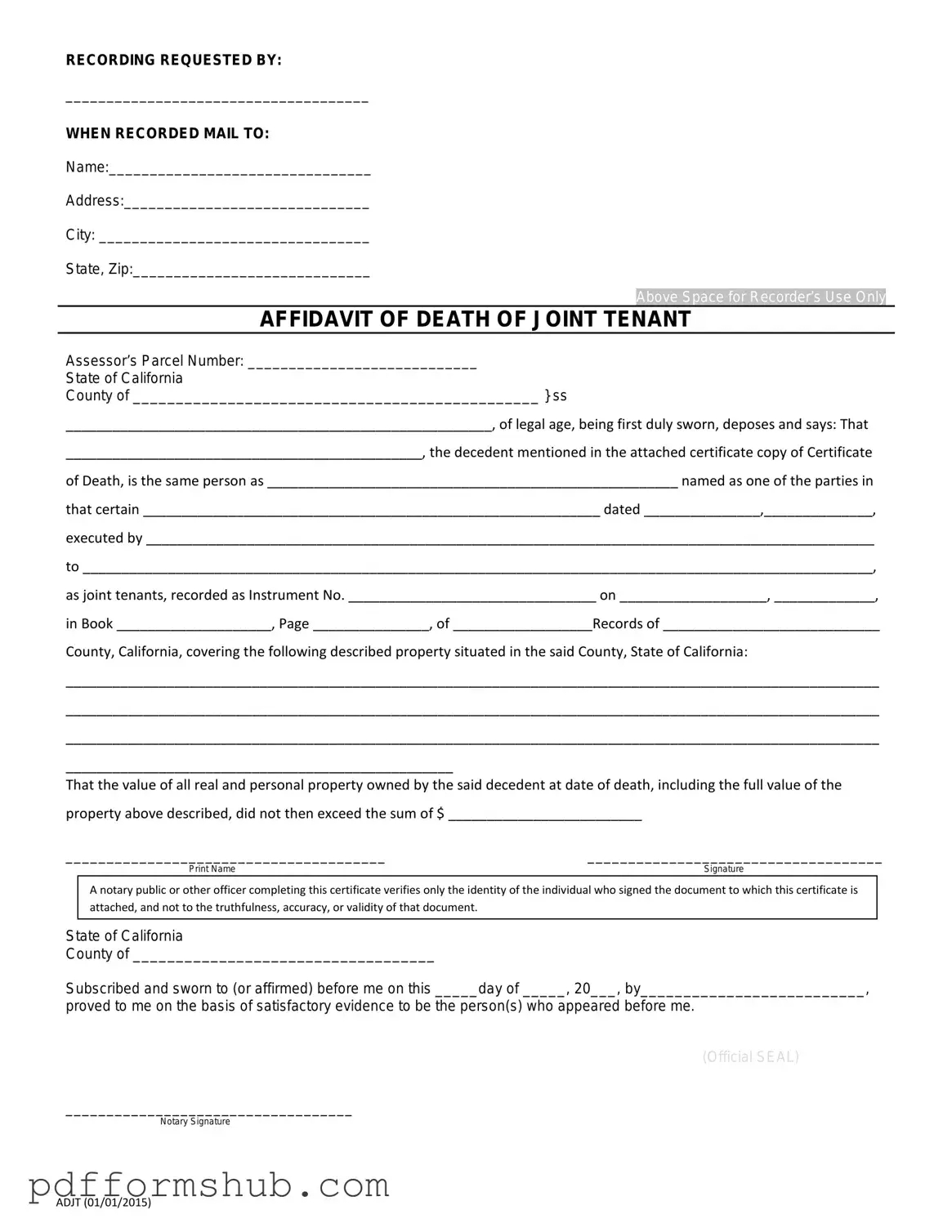

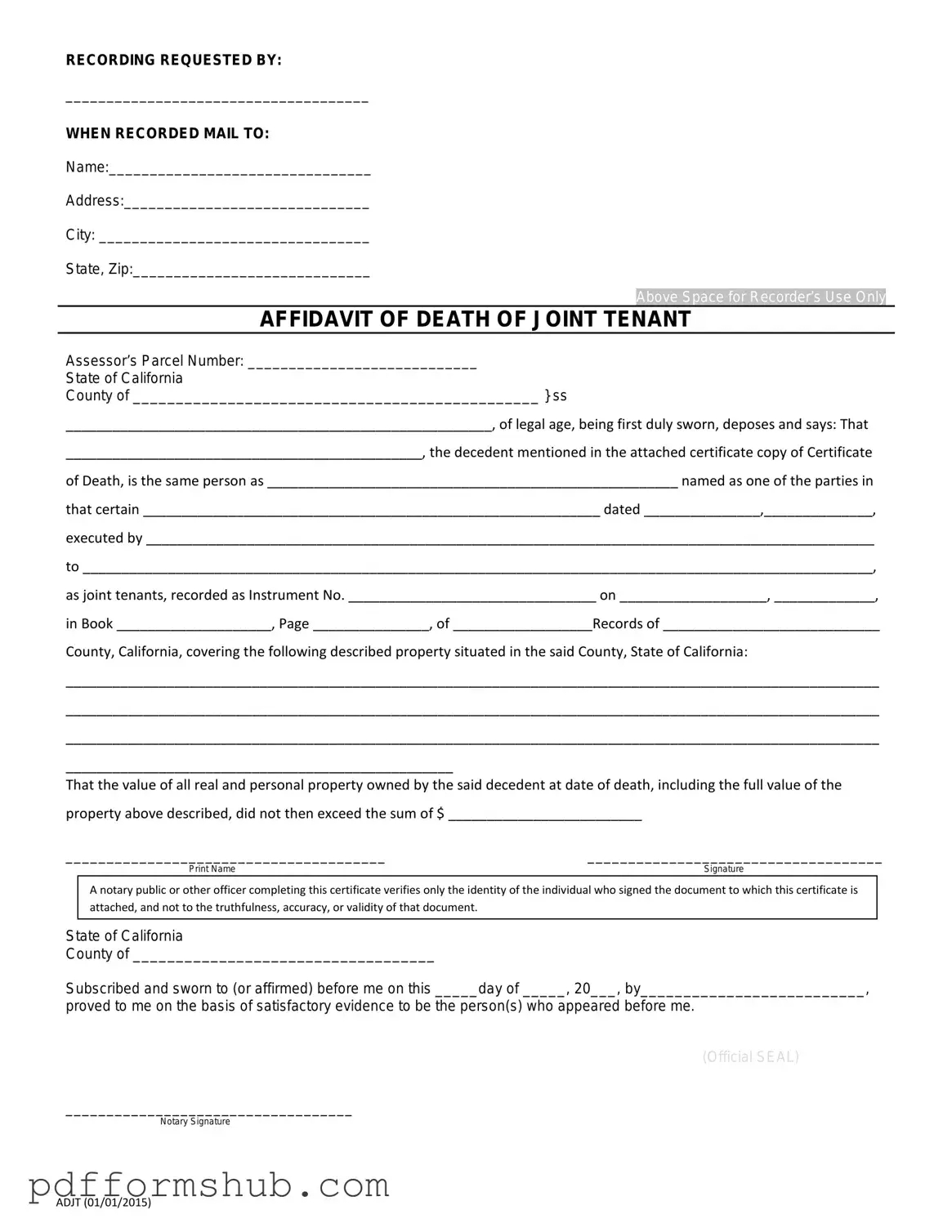

Fill in Your California Death of a Joint Tenant Affidavit Form

The California Death of a Joint Tenant Affidavit form serves as an essential legal document that facilitates the transfer of property ownership when one joint tenant passes away. This affidavit helps clarify the status of the property and ensures that the remaining joint tenant can assert their rights without unnecessary complications. Understanding the importance of this form can simplify the process during a difficult time.

To fill out the form, click the button below.

Customize Form

Fill in Your California Death of a Joint Tenant Affidavit Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete California Death of a Joint Tenant Affidavit online without printing hassles.