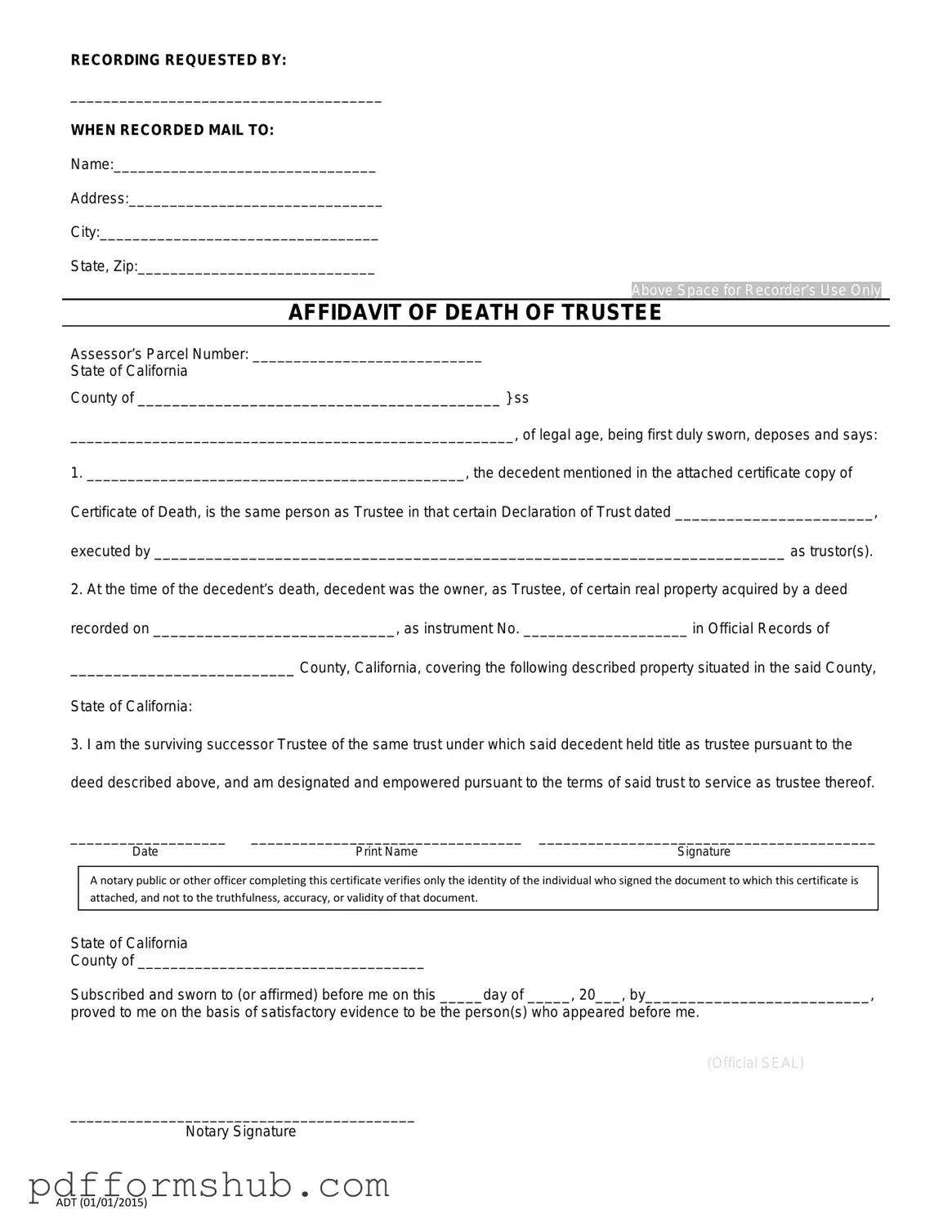

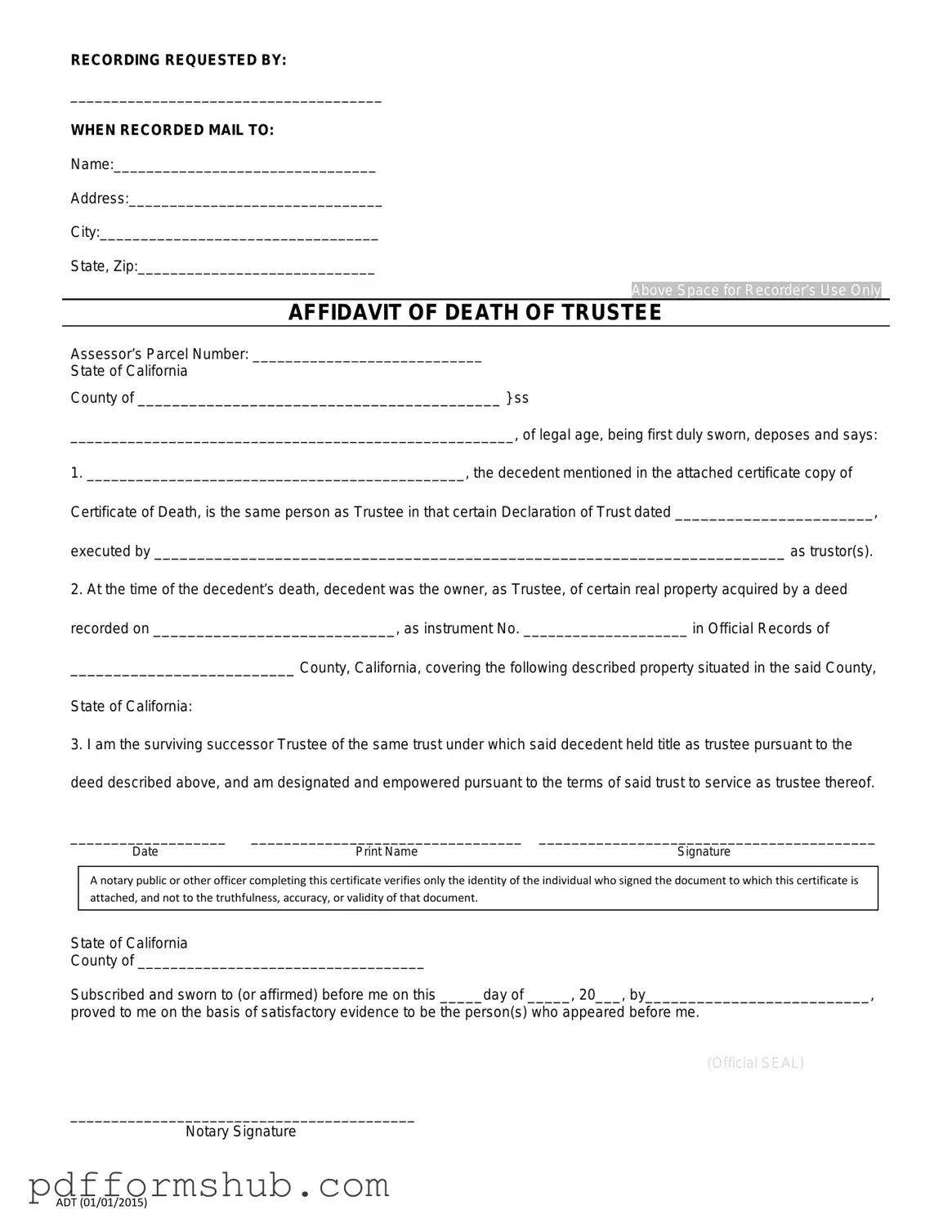

Fill in Your California Affidavit of Death of a Trustee Form

The California Affidavit of Death of a Trustee is a legal document used to officially declare the death of a trustee in a trust. This form helps facilitate the transition of responsibilities and ensures that the trust can continue to be managed properly. Understanding how to fill out this form is essential for those involved in trust administration.

Ready to get started? Fill out the form by clicking the button below.

Customize Form

Fill in Your California Affidavit of Death of a Trustee Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete California Affidavit of Death of a Trustee online without printing hassles.