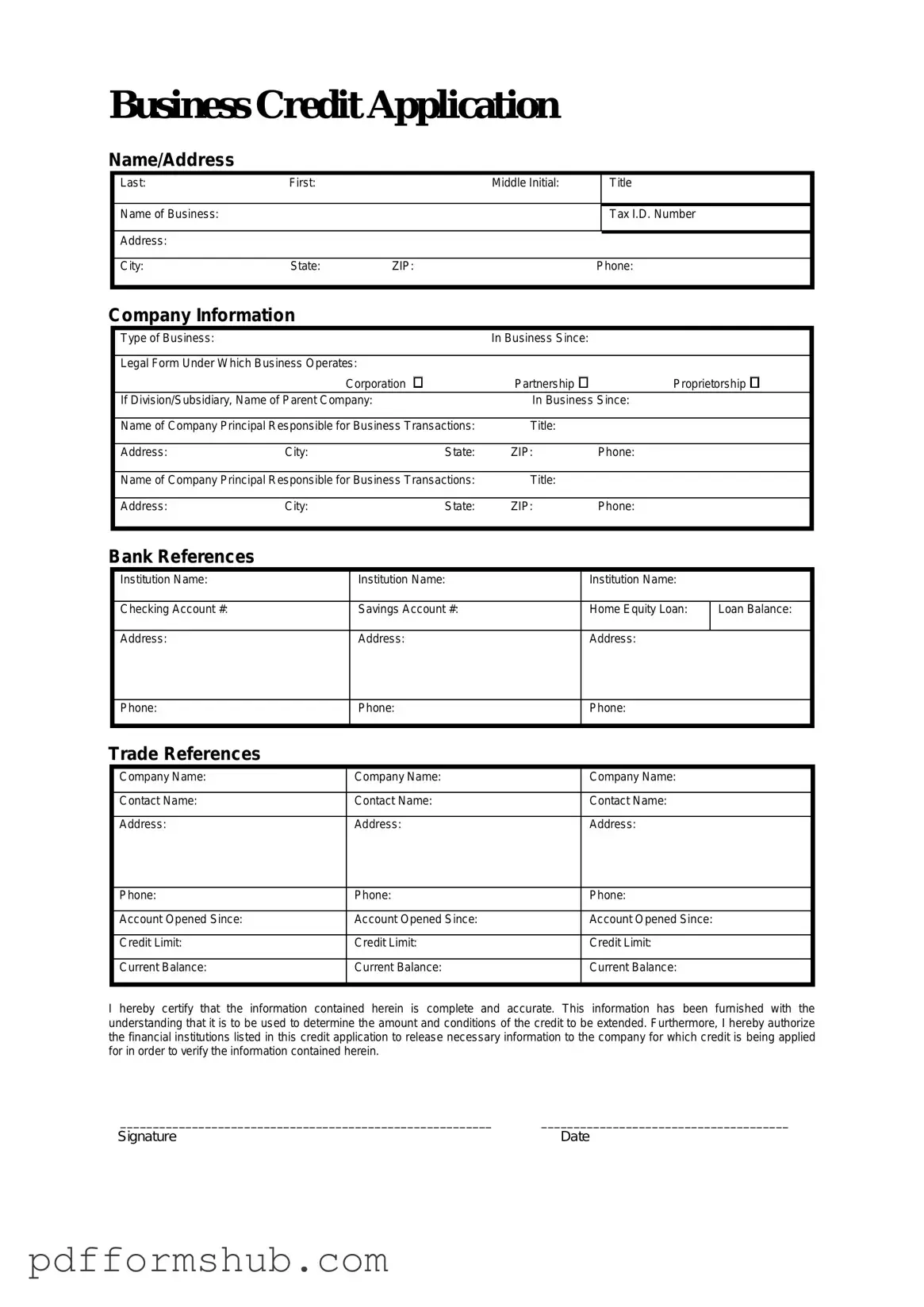

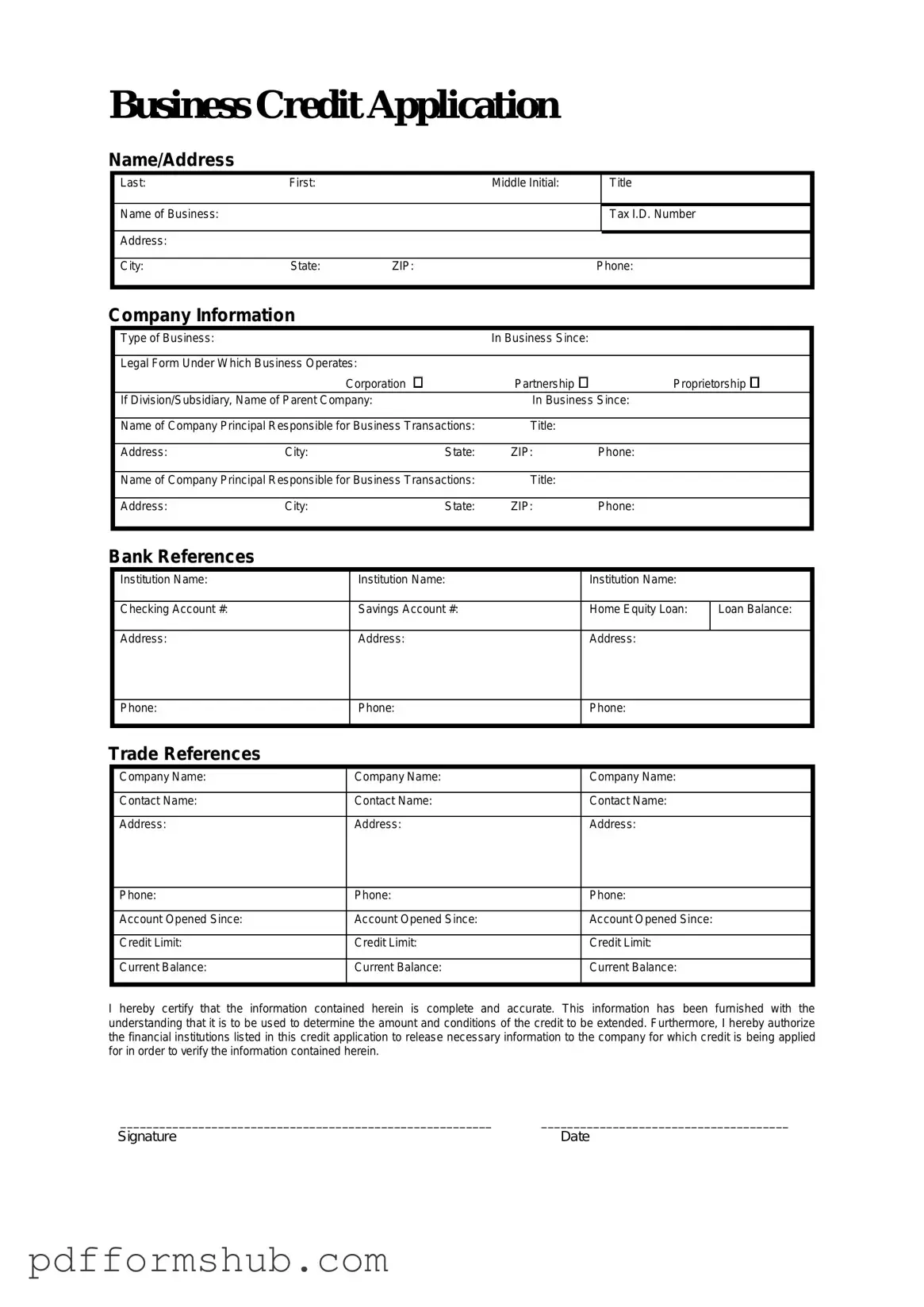

Fill in Your Business Credit Application Form

A Business Credit Application form is a document that businesses use to apply for credit from suppliers or lenders. This form typically collects essential information about the business, including its financial history and creditworthiness. Completing this form accurately is crucial for securing the necessary funding to support your business operations.

Ready to take the next step? Fill out the form by clicking the button below.

Customize Form

Fill in Your Business Credit Application Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Business Credit Application online without printing hassles.