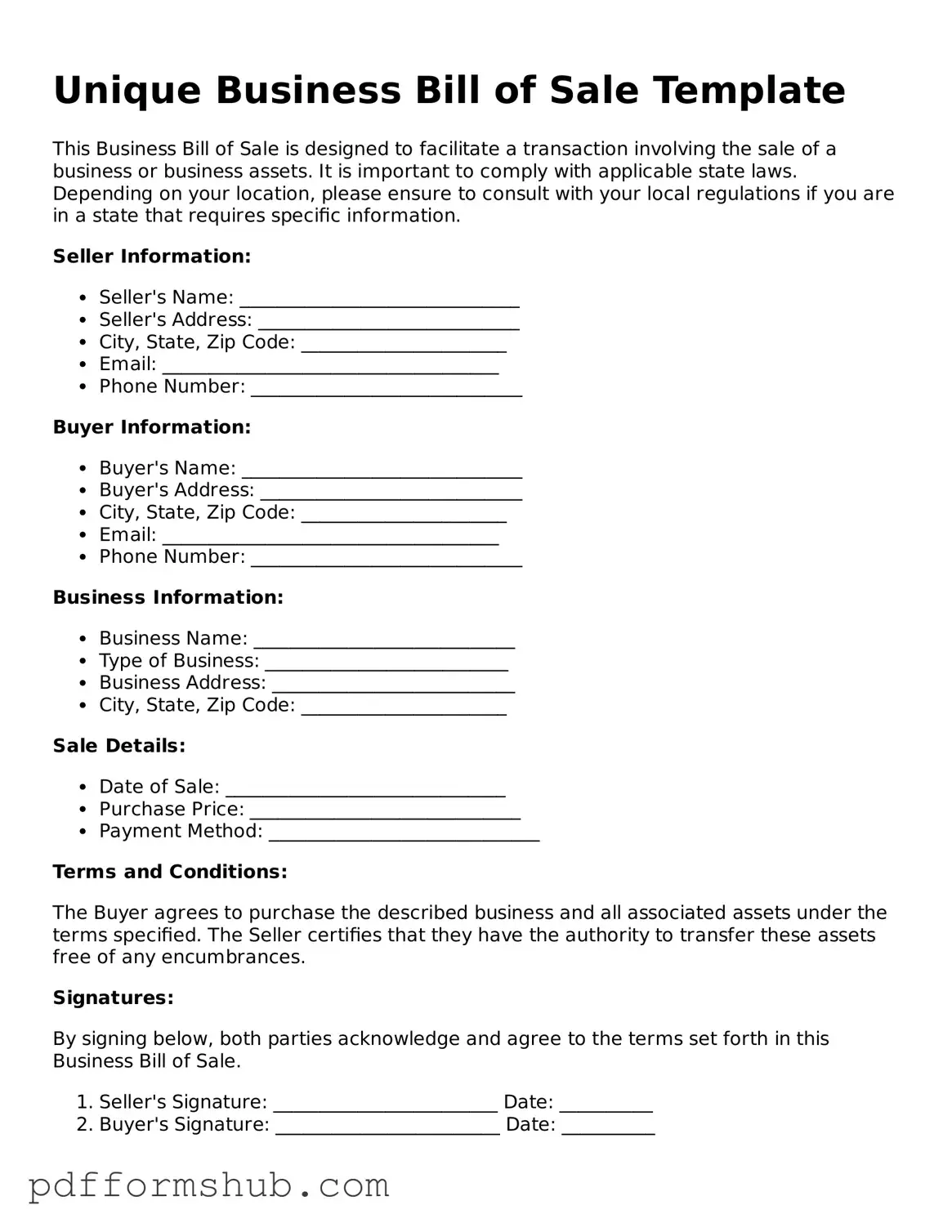

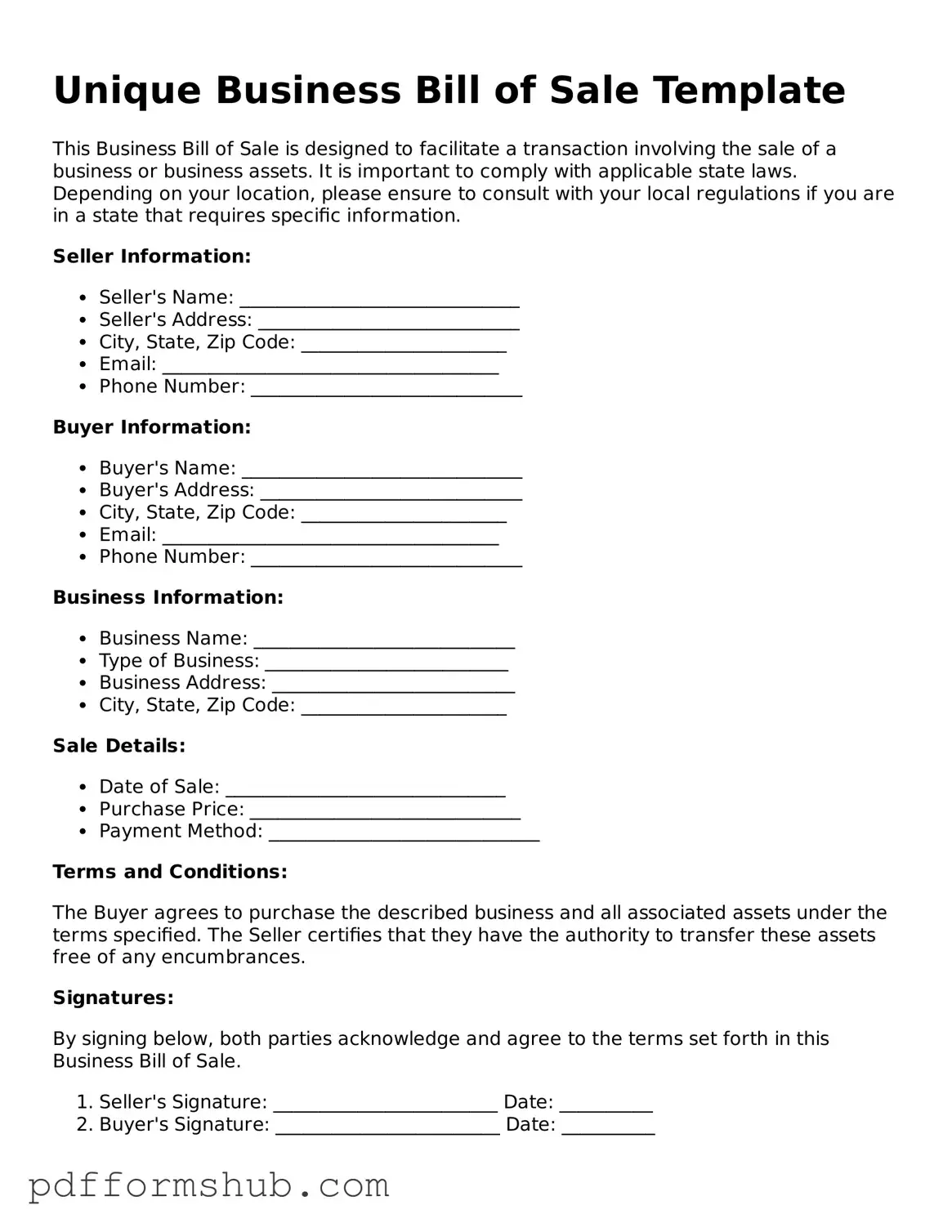

Valid Business Bill of Sale Form

A Business Bill of Sale form is a legal document that transfers ownership of a business or its assets from one party to another. This form serves as proof of the transaction and outlines the terms agreed upon by both parties. Ensure a smooth transfer by filling out the form accurately; click the button below to get started.

Customize Form

Valid Business Bill of Sale Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Business Bill of Sale online without printing hassles.