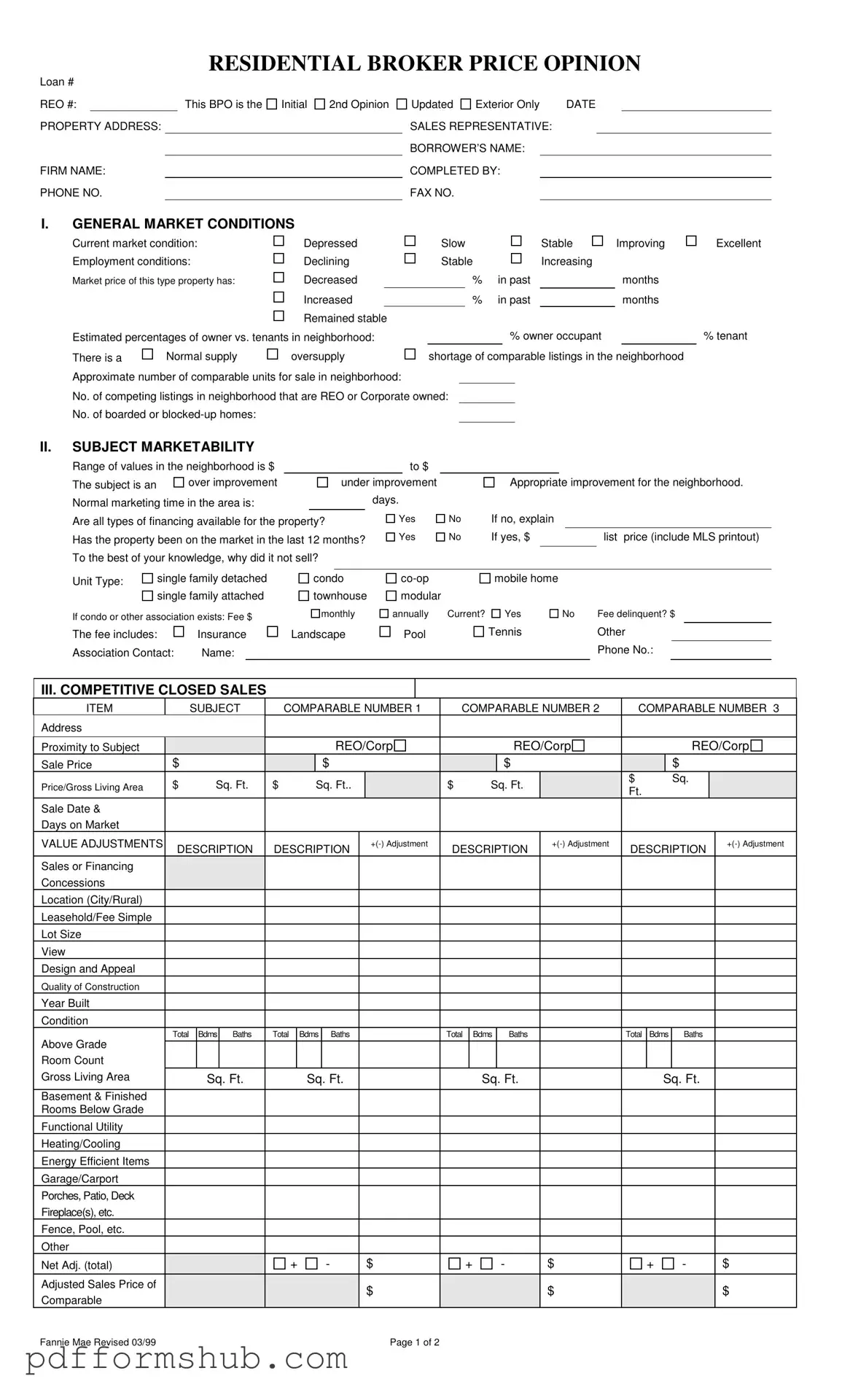

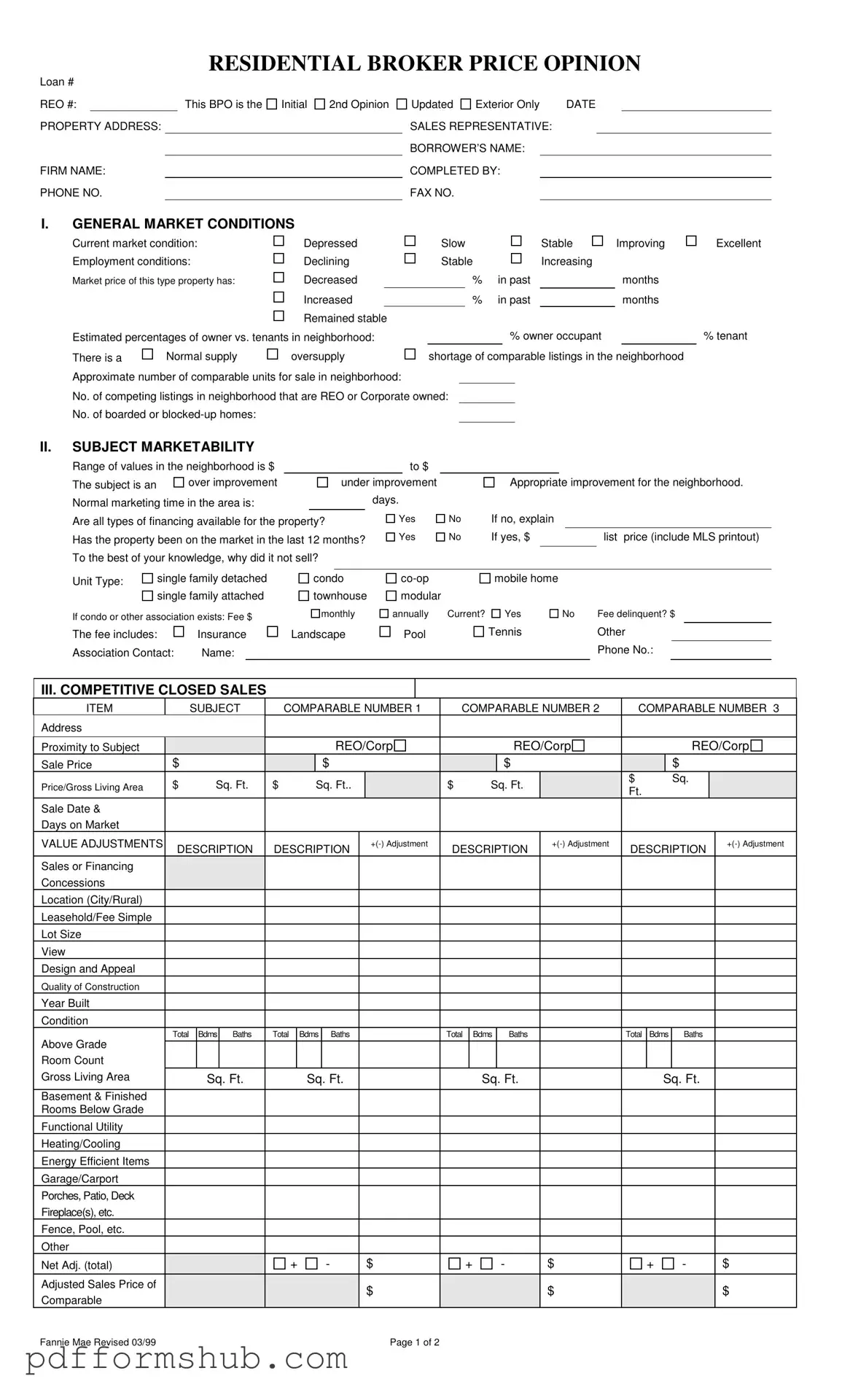

Fill in Your Broker Price Opinion Form

A Broker Price Opinion (BPO) is a document that provides an estimate of a property's value, typically prepared by a real estate broker or agent. This form is essential for lenders and investors when assessing the market value of a property, especially in situations involving foreclosures or short sales. Understanding how to accurately complete this form can significantly impact the decision-making process regarding property transactions.

If you're ready to fill out the Broker Price Opinion form, click the button below.

Customize Form

Fill in Your Broker Price Opinion Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Broker Price Opinion online without printing hassles.