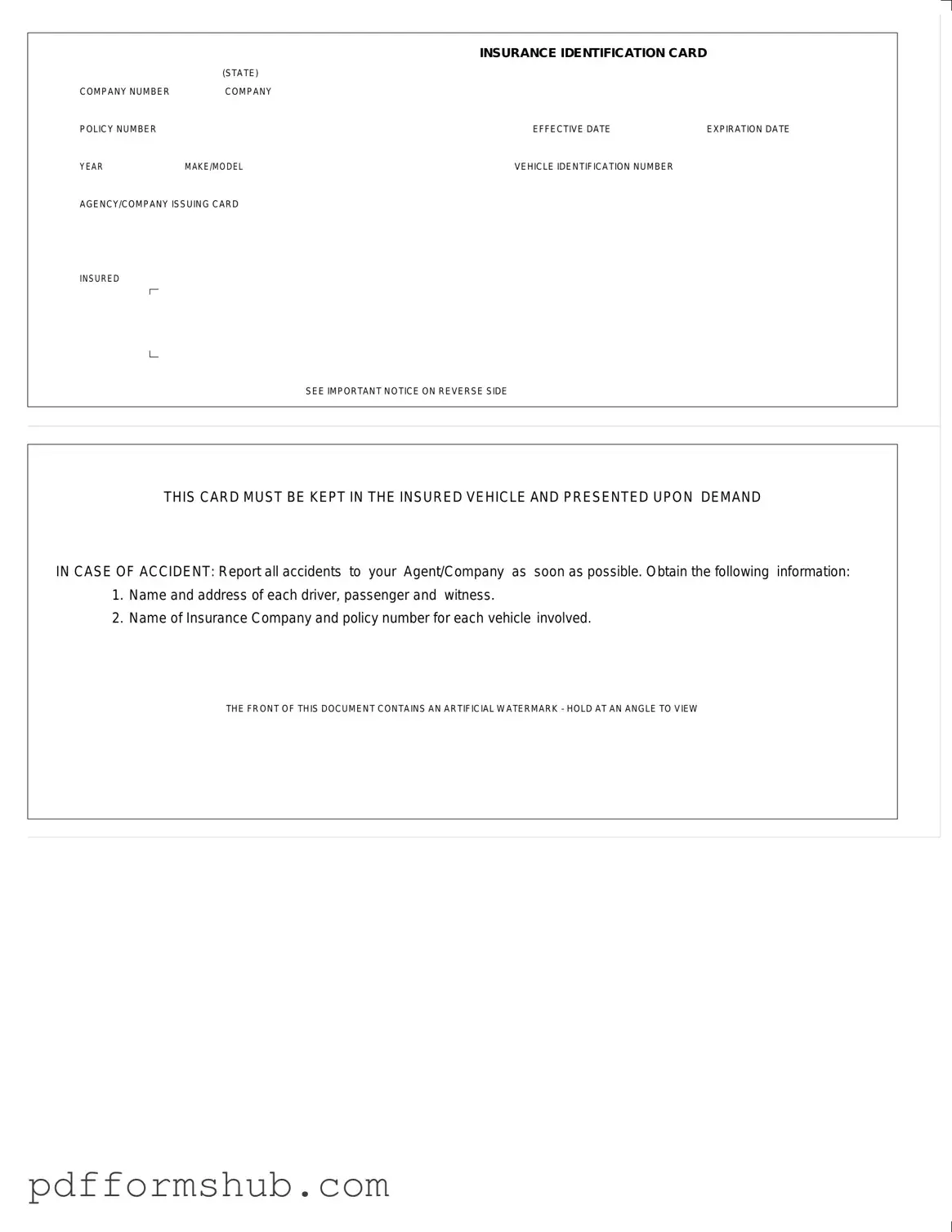

Fill in Your Auto Insurance Card Form

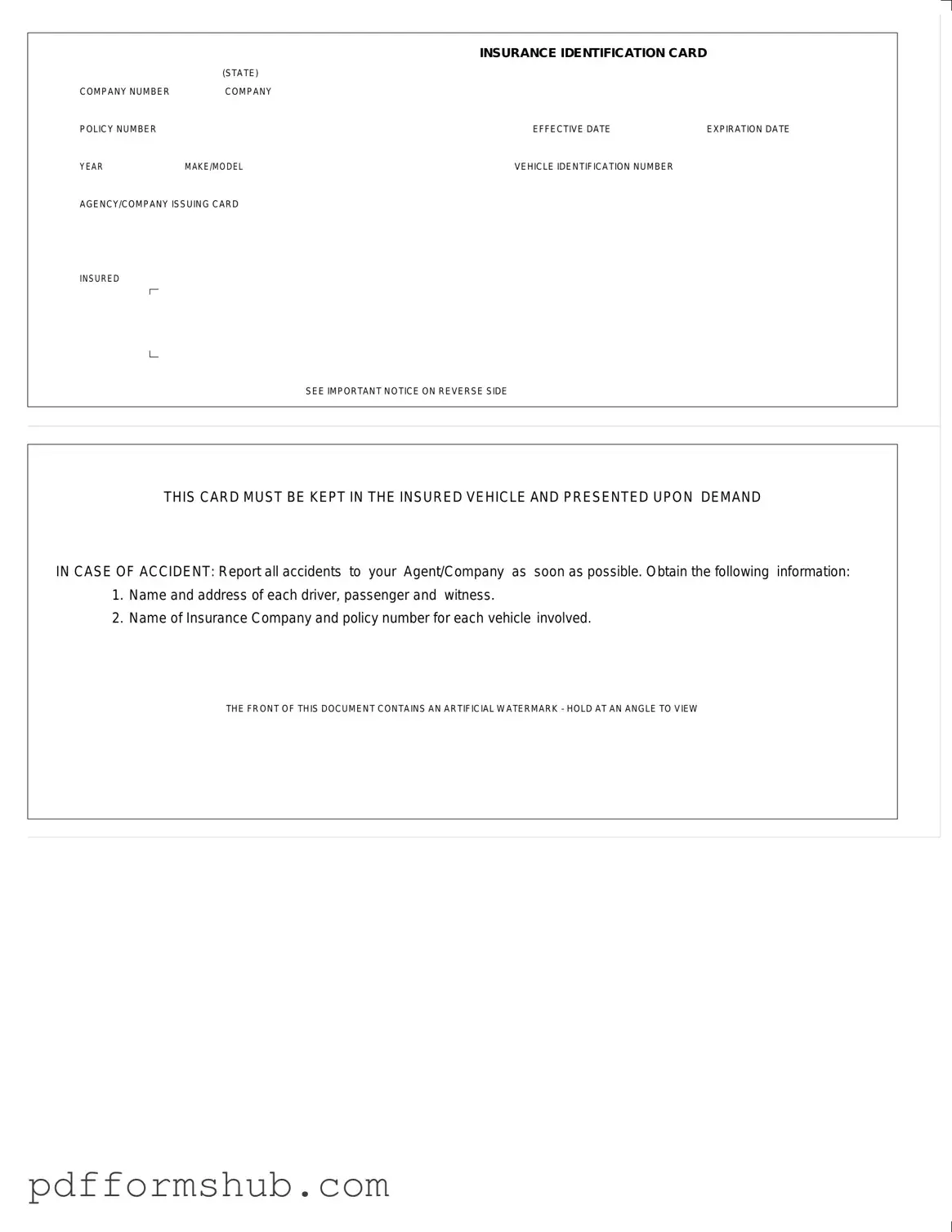

The Auto Insurance Card serves as proof of your auto insurance coverage. It includes essential details such as the company number, policy number, effective dates, and vehicle information. Keep this card in your vehicle and present it upon request, especially in the event of an accident.

To ensure you have the correct information, please fill out the form by clicking the button below.

Customize Form

Fill in Your Auto Insurance Card Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Auto Insurance Card online without printing hassles.