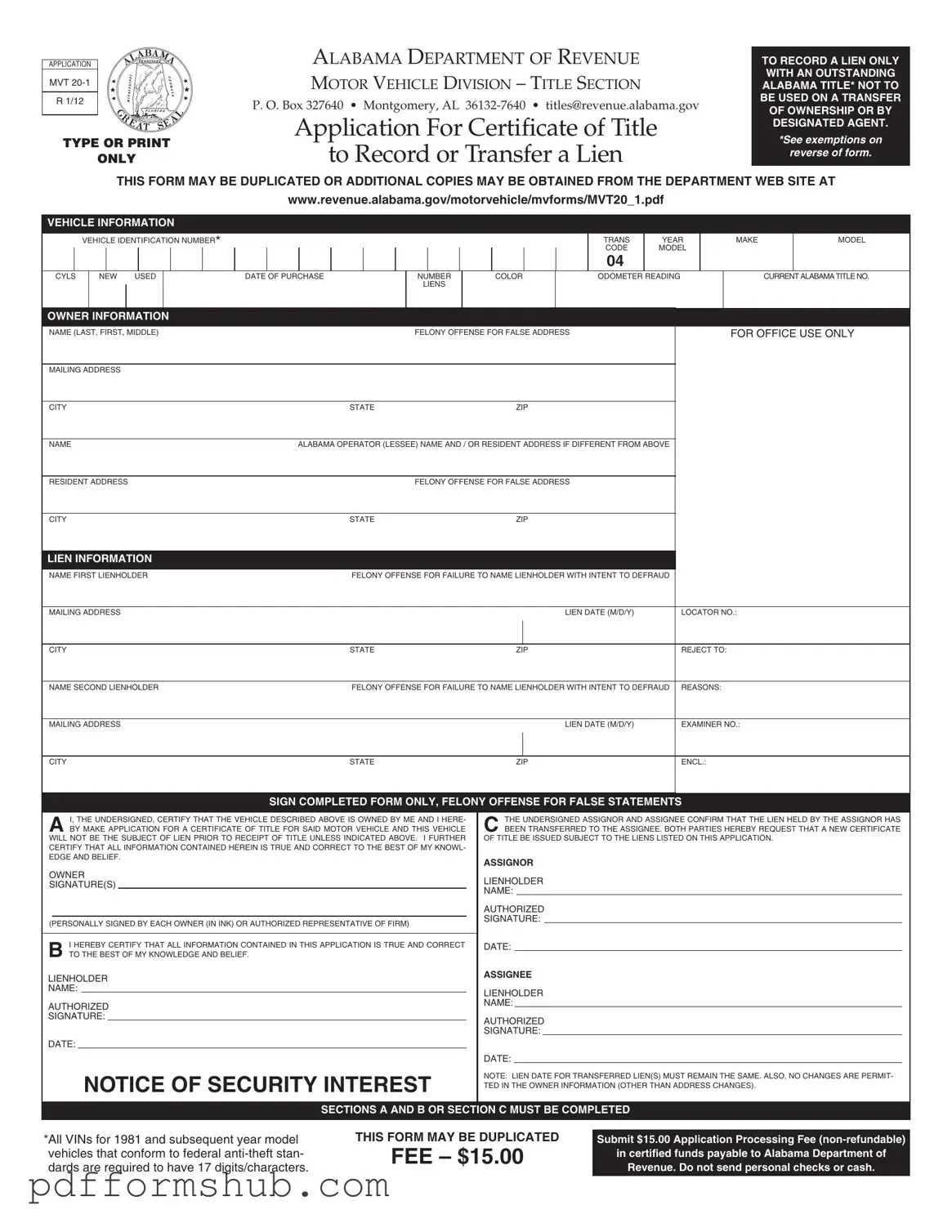

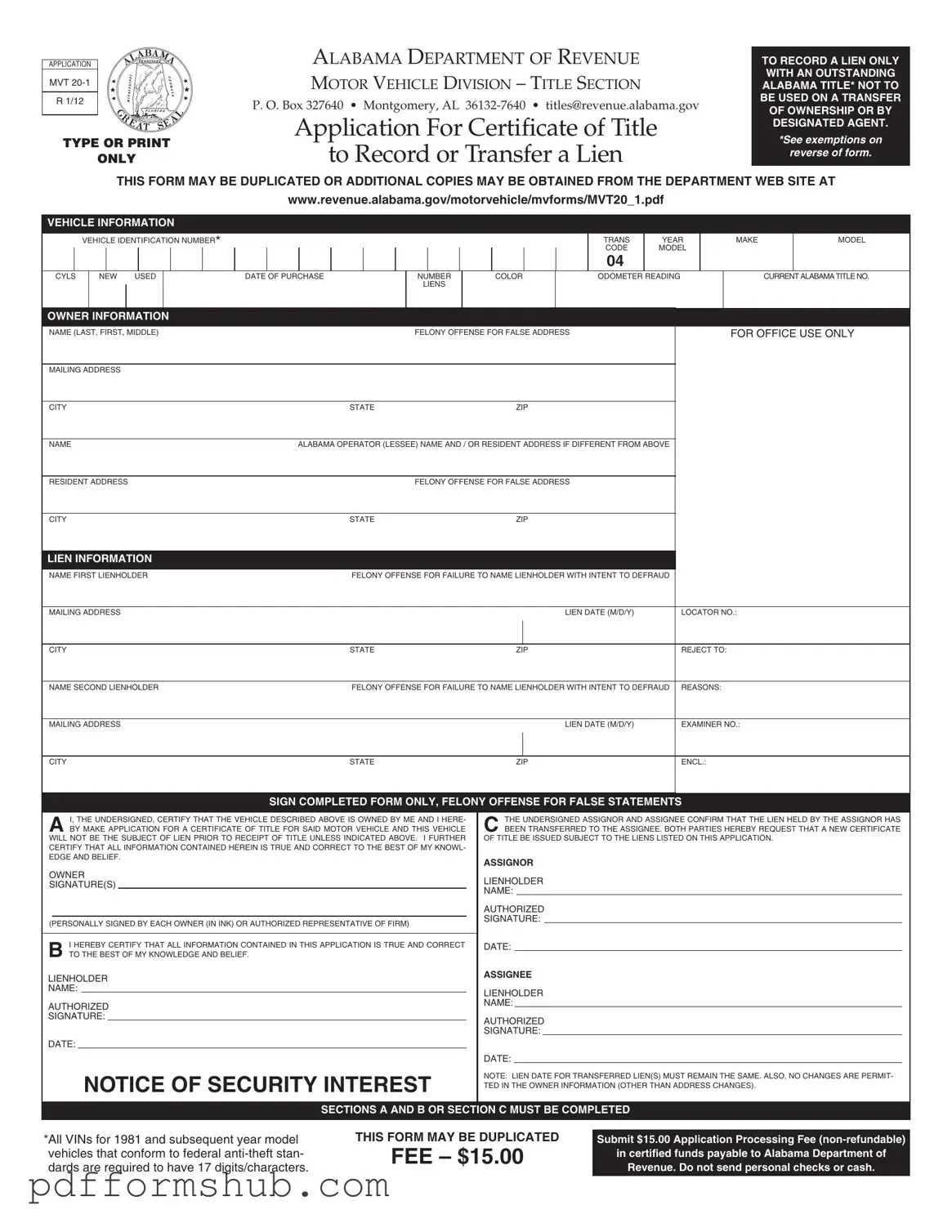

Fill in Your Alabama Mvt 20 1 Form

The Alabama Mvt 20 1 form is an application used to record or transfer a lien on a vehicle that has an outstanding Alabama title. This form is specifically designed for lienholders and should not be used for ownership transfers or by designated agents. To ensure compliance with Alabama law, fill out the form accurately and completely.

Start the process of recording your lien by clicking the button below.

Customize Form

Fill in Your Alabama Mvt 20 1 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Alabama Mvt 20 1 online without printing hassles.