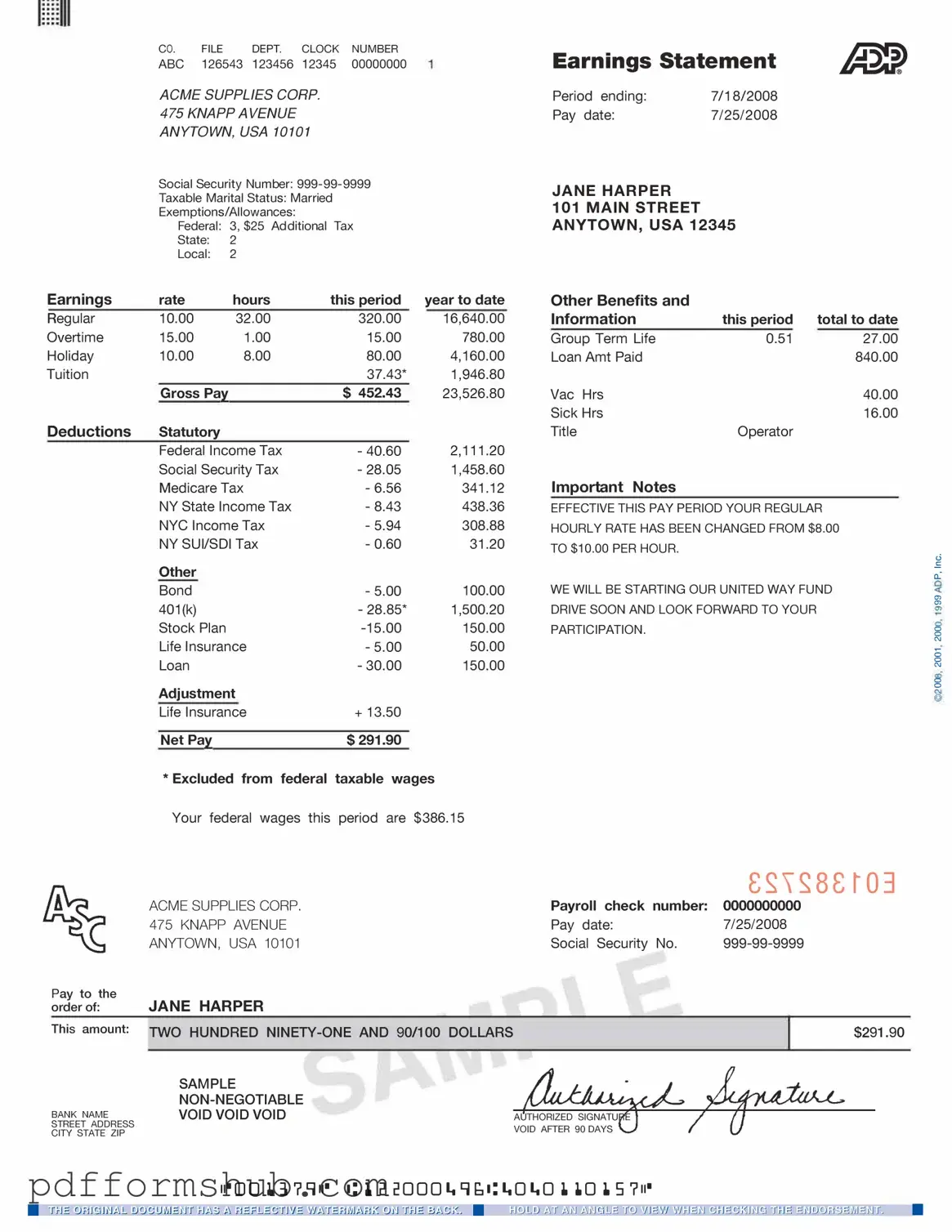

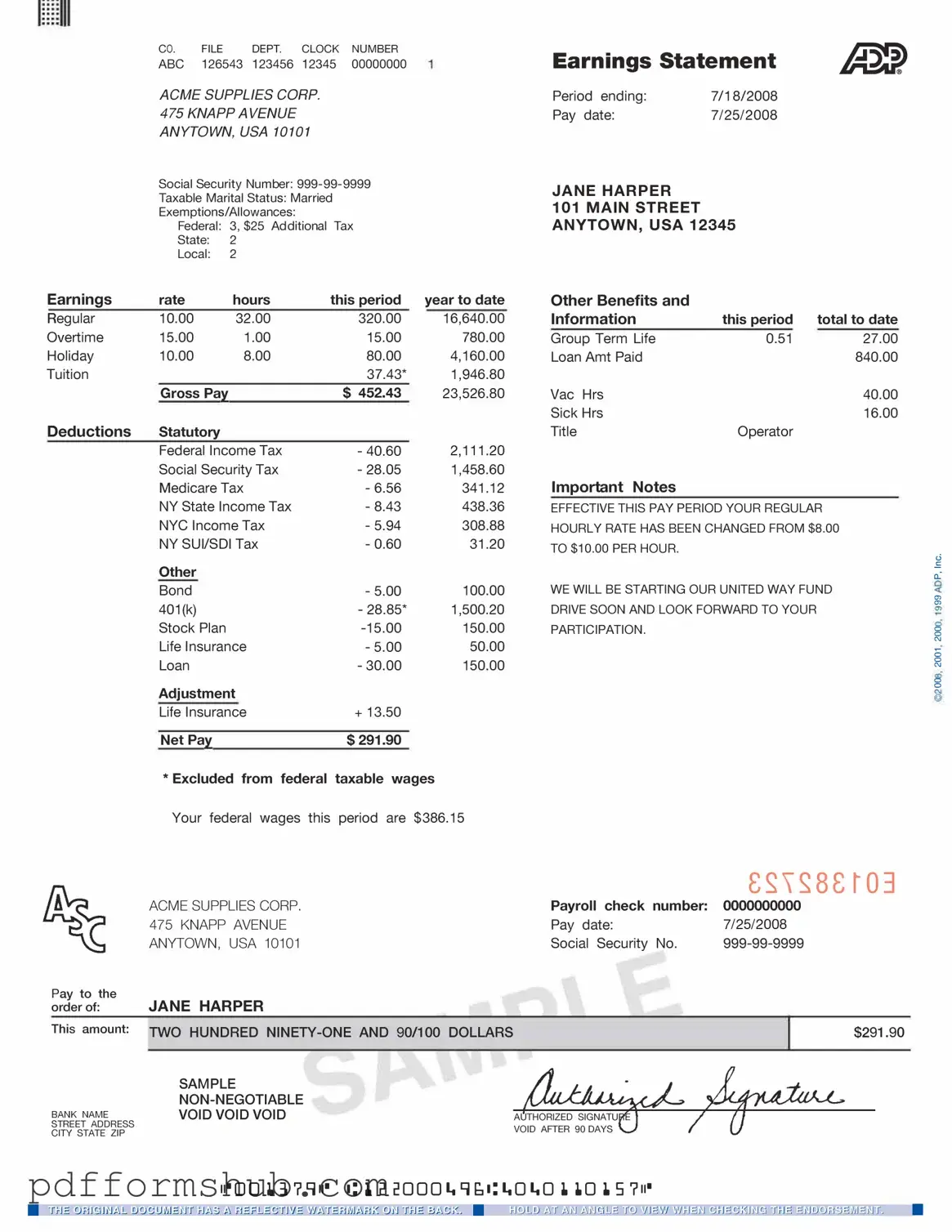

Fill in Your Adp Pay Stub Form

The ADP Pay Stub form is a document that provides employees with a detailed breakdown of their earnings, deductions, and net pay for a specific pay period. This form is essential for understanding one's compensation and tax contributions. To ensure accurate record-keeping and financial planning, consider filling out the form by clicking the button below.

Customize Form

Fill in Your Adp Pay Stub Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Adp Pay Stub online without printing hassles.