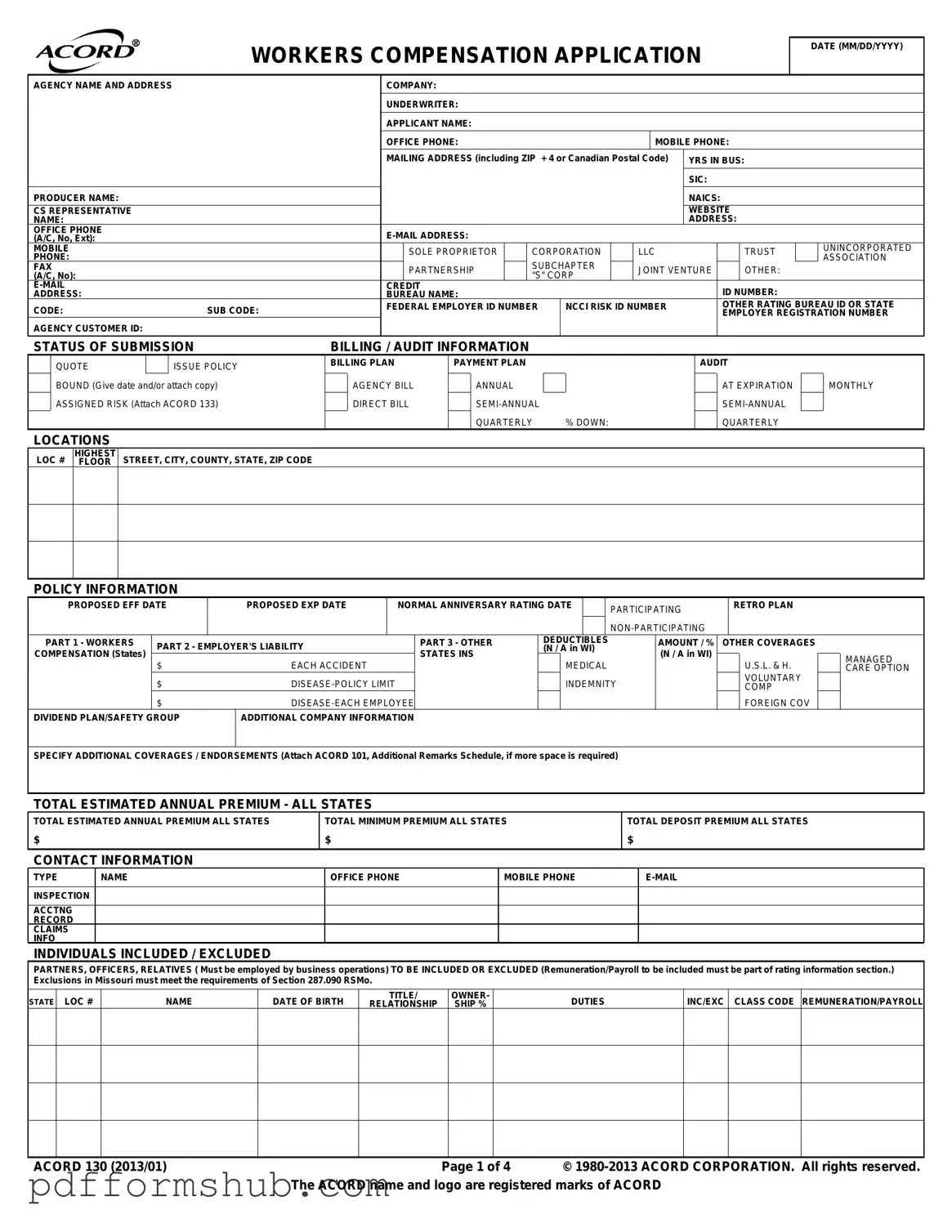

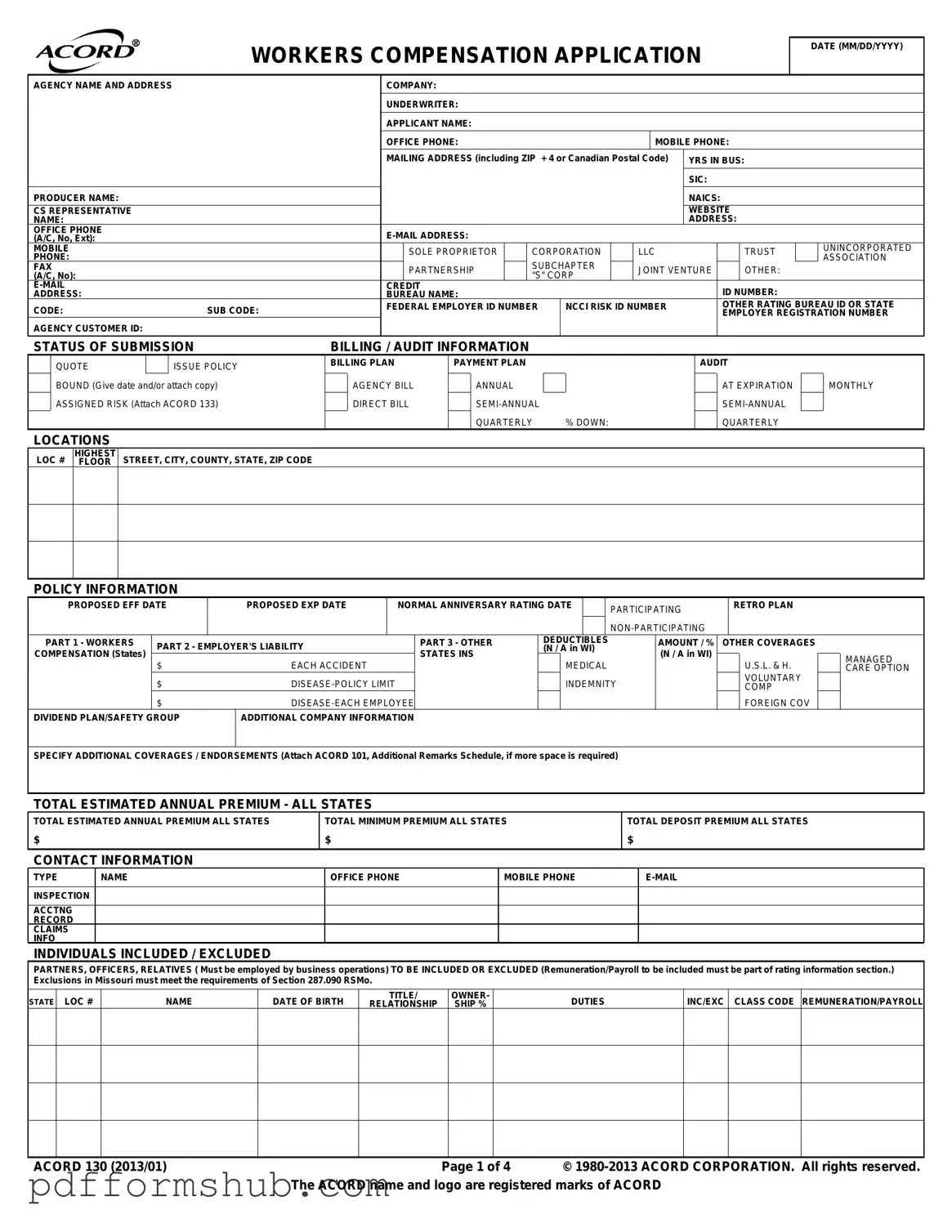

Fill in Your Acord 130 Form

The ACORD 130 form is a critical document used to apply for workers' compensation insurance. It gathers essential information about a business, including its operations, employee details, and coverage needs. Completing this form accurately is vital for securing the appropriate insurance coverage for your business.

Ready to fill out the ACORD 130 form? Click the button below to get started!

Customize Form

Fill in Your Acord 130 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete Acord 130 online without printing hassles.