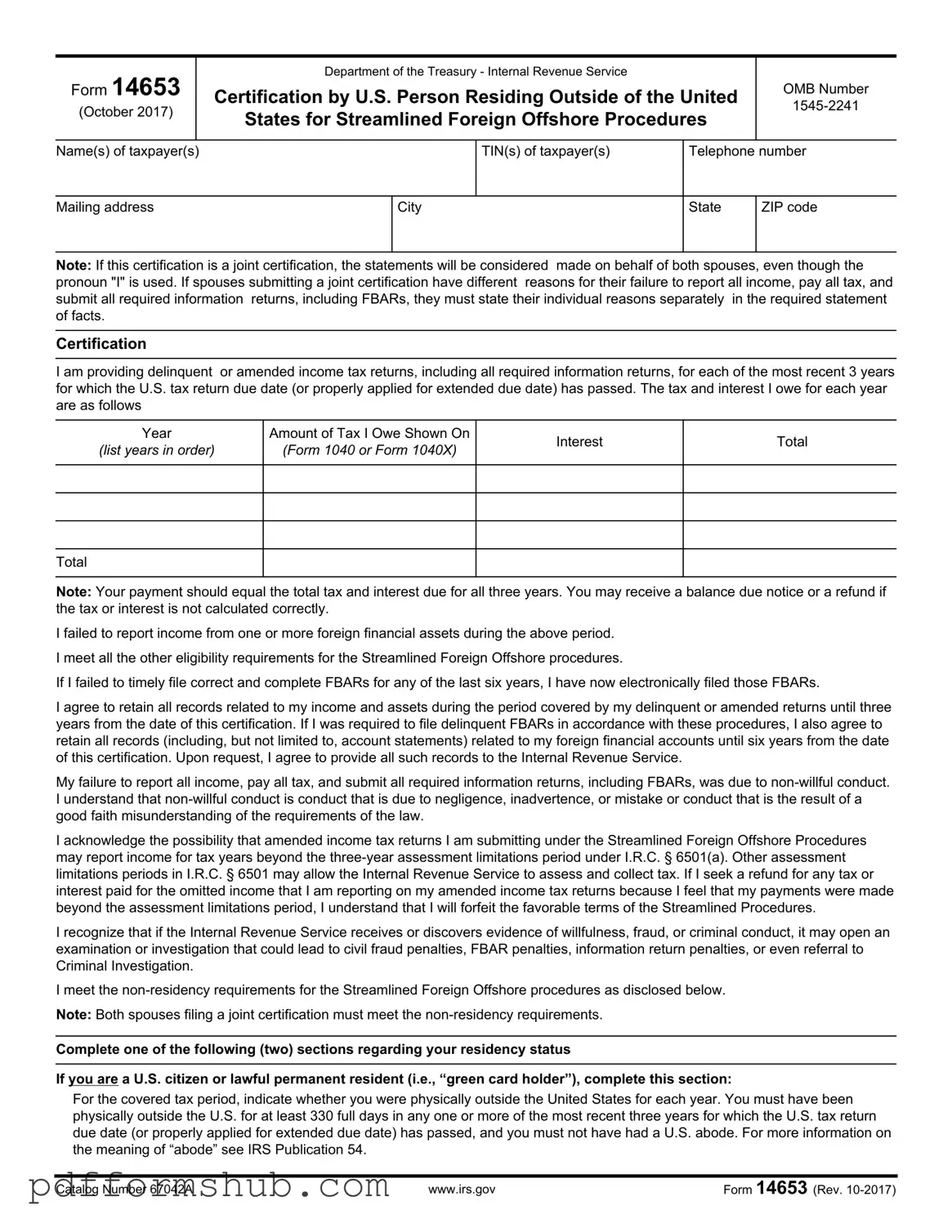

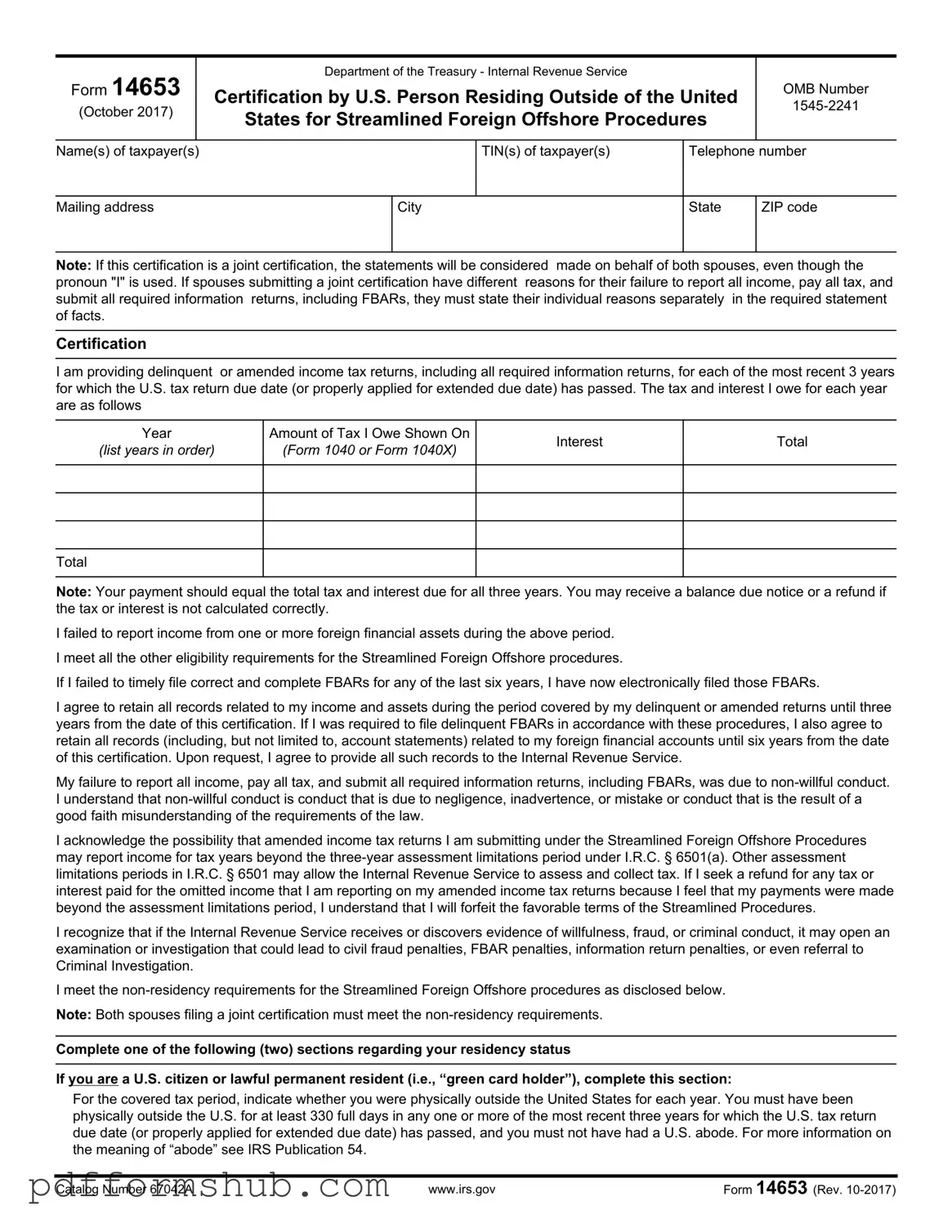

Fill in Your 14653 Form

Form 14653 is a certification document used by U.S. persons residing outside of the United States to participate in the Streamlined Foreign Offshore Procedures. This form allows individuals to rectify their tax filing status and address any unreported income or tax obligations. If you need to fill out this form, please click the button below to get started.

Customize Form

Fill in Your 14653 Form

Customize Form

Customize Form

or

Free PDF Form

Short deadline? Complete this form now

Complete 14653 online without printing hassles.